Blog/E-Commerce/Social Commerce in China 2024 - 6 Elements to Succeed

In this article, we will cover all you need to know about social commerce in China. This includes how big it is, its various elements, and how it will develop going forward.

Did you know that China is currently the LARGEST eCommerce market in the world? And one of the main factors that propel it to the forefront is the development of social commerce in China.

Therefore, to win the heart of Chinese consumers in such a competitive marketplace, you need to dive deep into how social media shape people's lives and their shopping habits. Everything can be found below.

Table of Contents

How Big is Social eCommerce in China?

Aside from dominating the general eCommerce space, China also has the most developed social commerce market in the world. In 2021, China social commerce market size has expanded to 2.5 trillion yuan (over $374 billion), with nearly 800 million participants.

Like most other countries, social media is a big part of people's daily lives here as well. But, to a much more immersive extent.

According to Statista, nearly 1 billion social media users were recorded in 2021. This has cemented China as the country with the largest social media population! And this figure is expected to reach nearly 1.3 billion by 2026.

In addition, an average Chinese internet user spends around 5 hours and 15 minutes per day online, nearly half of which is for browsing social media. But it is not just for communication and keeping up with the news.

Social media are also excellent platforms for discovering new products, doing research on them, finding deals, and even making purchases! In fact, a survey in 2020 revealed that over 70% of Chinese consumers felt inclined to shop via social media channels. This rate is much higher than the global average of only 42%.

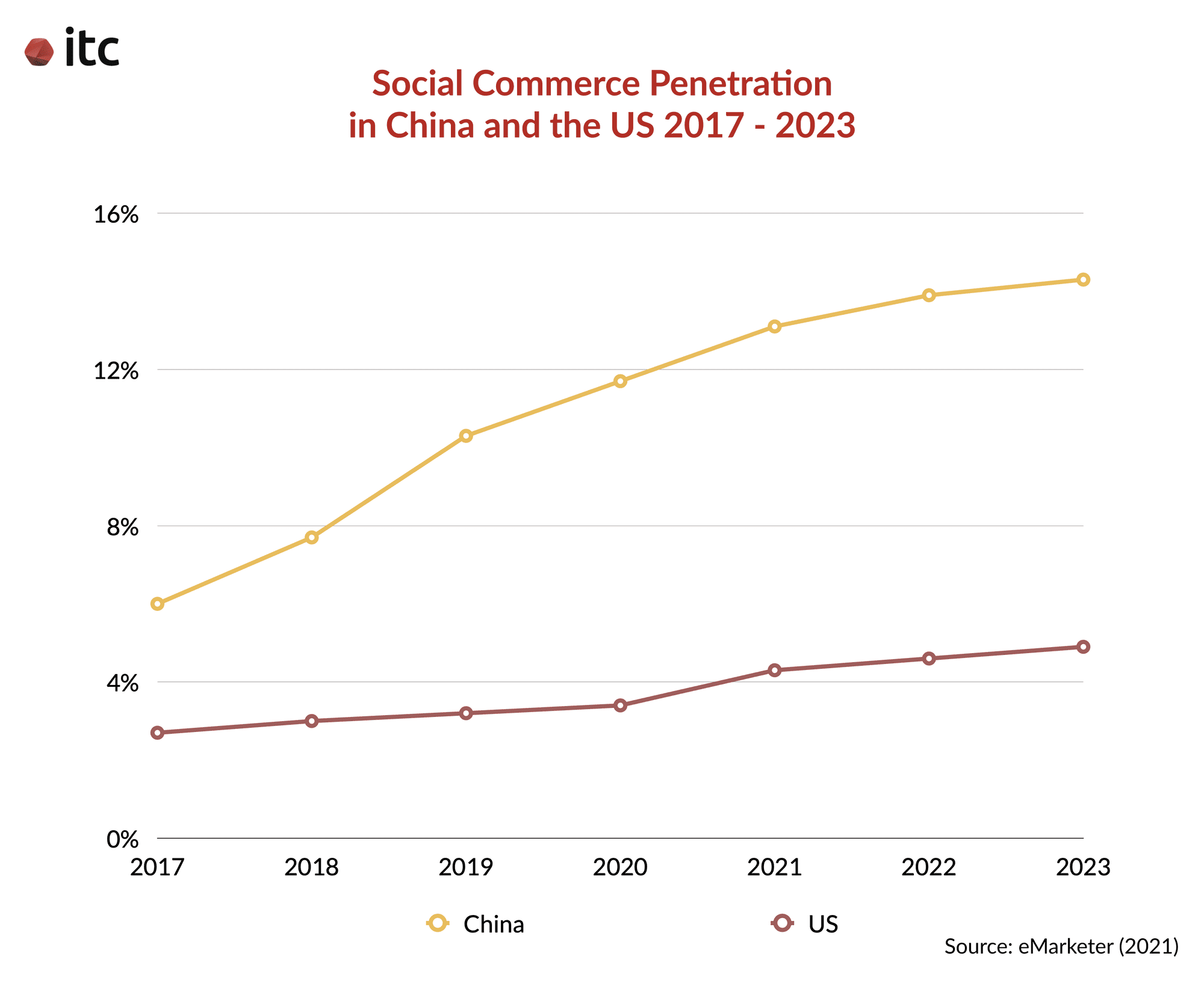

How come? Chinese people's openness to online shopping and social shopping, more specifically, can be attributed to how developed the market is. According to eMarketer, China's social commerce penetration rate experiences a much more rapid growth than the US's.

In particular, China's sales via social media channels contributed 6% to the total retail eCommerce revenue in 2017. And, that figure has doubled to reach over 13% in just 4 years!

On the other hand, the US's social commerce market underwent a much more modest development. Its penetration rate went from 2.7% in 2017 to 4.3% in 2021.

In the near future, eMarketer also forecasts that China will continue to dominate in both sales volume and growth speed. So, what exactly has been pumping social commerce growth in China?

Why is Social eCommerce so Successful in China?

Established & Saturated eCommerce Market

If you stay up-to-date with the eCommerce landscape in China, you would know that it is very well-developed and has become overly saturated now.

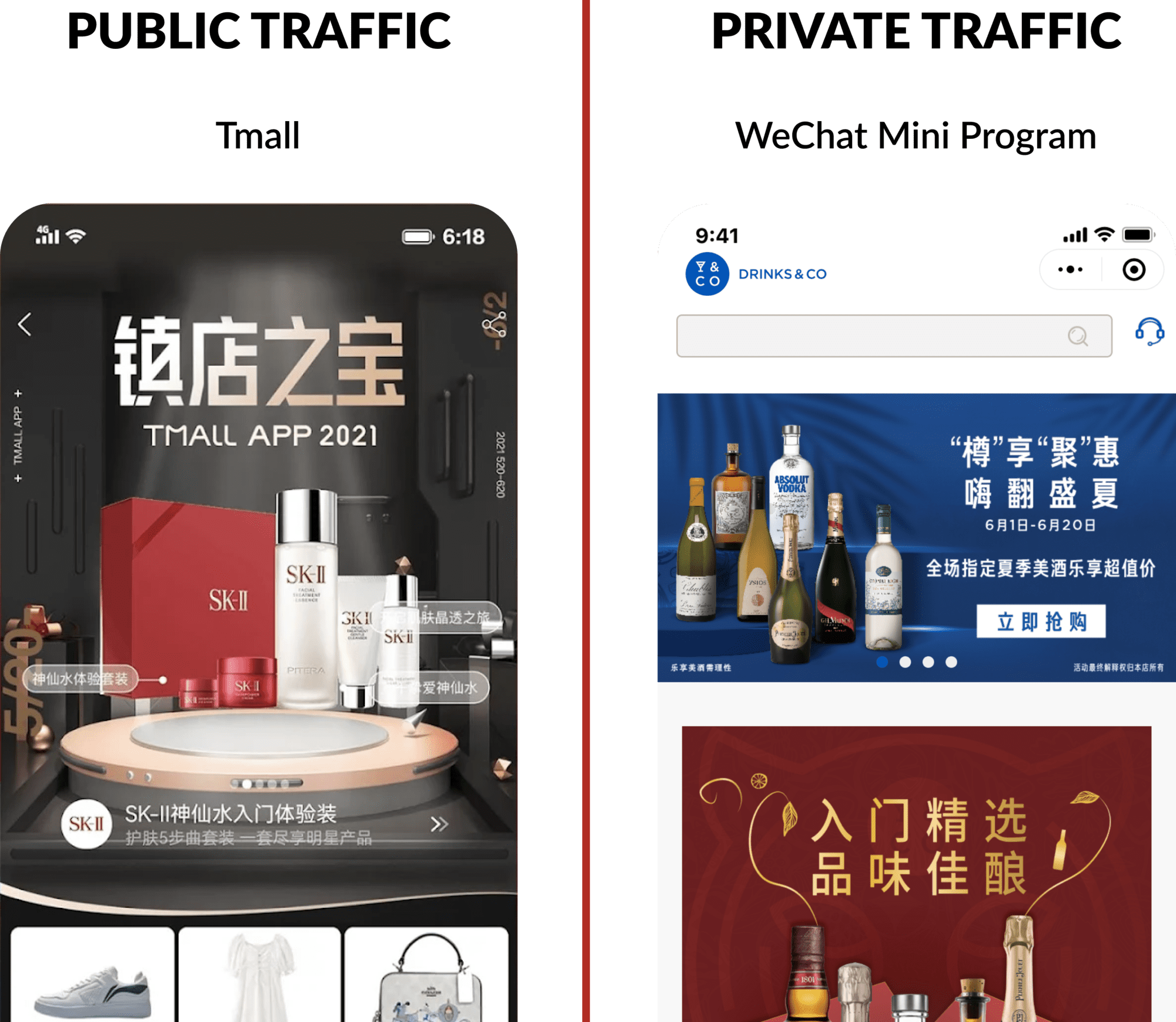

Brands face intense competition in the public sector in public marketplaces like Tmall, JD.com, and Pinduoduo. In fact, those 3 top B2C retail platforms have already taken up nearly 80% of the total market.

In light of the rising consumer acquisition costs, companies are diversifying their approach to capture private traffic as well. This includes traffic to:

- Their branded website (.cn)

- Their WeChat Mini Programs (MPs), a sub-application inside China's top social media/messaging platform WeChat

In other words, social media channels like WeChat are emerging as a solution to mitigate the bottleneck issue of China's e-Commerce market.

Valuable Touchpoint

As mentioned above, an average Internet user in China spends nearly half of their time online browsing social media. And they do not just access them at home. The extremely high mobile penetration rate enables Chinese people to stay online and social anywhere.

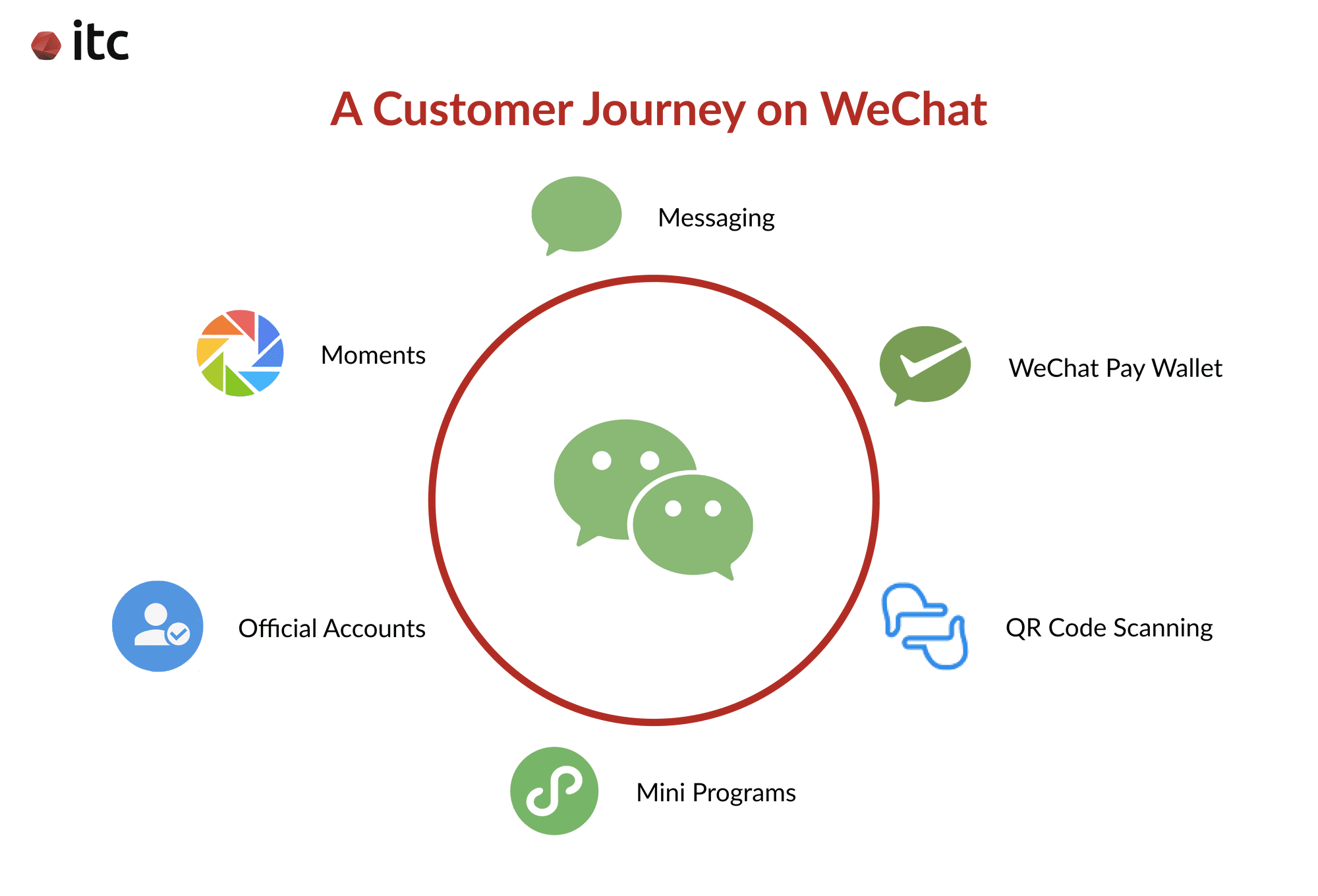

As a result, this has prompted the seamless integration of social media into every aspect of their daily lives, from online to offline, with WeChat as the front-runner. Take a look at this customer journey, for example:

- Use the regular messaging function and WeChat Moments feed to keep in touch with friends

- Access WeChat Official Accounts (OAs) and Mini Programs to contact and enjoy different brands' services

- Utilize WeChat Pay as a digital wallet for both online and offline purchases

- Make use of the QR code scanning feature on the app to scan any code they approach

Along with the extended length of time Chinese people spend on social media, this is also where they can connect with their friends, families, and anyone on the Internet.

Thus, social media platforms can serve as a valuable touchpoint for brands to effectively:

- Reach customers

- Facilitate purchases

- Serve them at any stage of the consumer life cycle

Furthermore, brands can also benefit from the natural flow of information within the apps via word-of-mouth. Users can easily share product/service information and proofs of engagement with the brand to others, right on the same platforms!

Ease of Use & Convenience

One of the main factors that make social e-Commerce so popular in China is how easy it is to make a purchase without navigating outside the app. The features that facilitate this ease of use include:

- One-click registration/login

- One-click purchase

And this is even more true for WeChat:

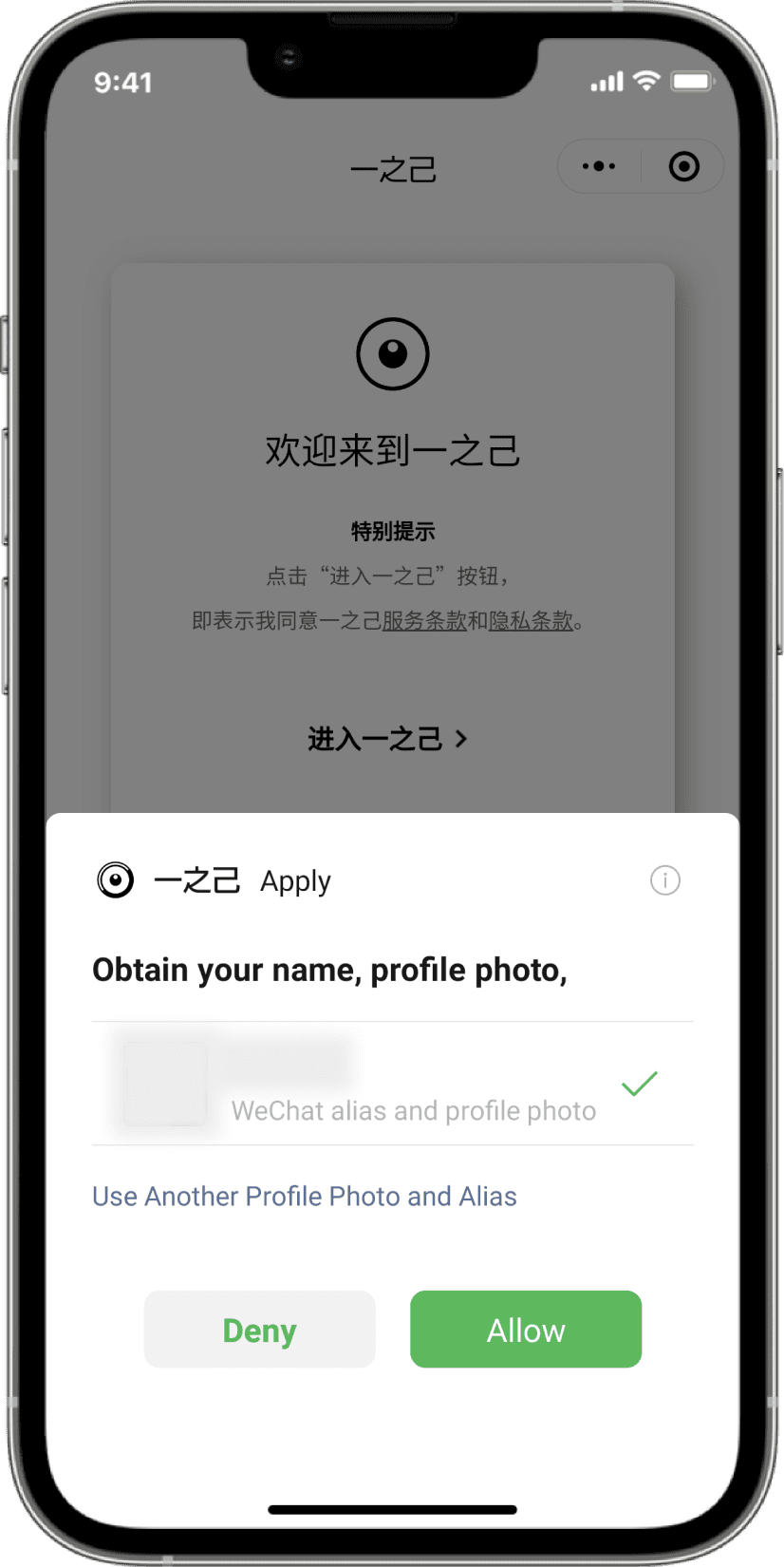

For example, WeChat APIs can activate the one-click authorization process, enabling users to effortlessly register or log in to receive a service or make a purchase within the WeChat ecosystem. Once they click on it, the system will automatically fill out previously captured information (e.g. name, phone number, address) stored on WeChat.

Additionally, the “Buy” button is intelligently embedded everywhere within the platform, from H5 campaigns to live streams. This allows the users to purchase their desired items at any time just with just a few clicks. This painless purchasing experience has made WeChat a highly popular social shopping platform in China.

Moreover, the convenience of the integrated digital wallet WeChat Pay also plays a big part. It reduces the effort involved in redirecting to another page or platform. Thus, it further convinces the users to buy the items right within the same ecosystem.

Tendencies of the Main User Base

And that is not all. This growth opportunity for social commerce arose at the right time to match the needs of the dominating and emerging consumer classes in China - Millennials and Gen Z. By 2016, Chinese Millennials and older Gen Zs had already accounted for over 50% of the country's digital buyers.

They are not big fans of push marketing via traditional ads. Hence, creative content creation and engagement building on social media channels where they frequent the most allow brands to construct a much more dynamic, interactive, entertaining, and personal connection with these demographics.

In addition, their behaviors should be noted as well. Generally, the younger demographics tend to have a more enhanced hedonistic attitude. They indulge in more pleasurable activities, including shopping, to treat themselves.

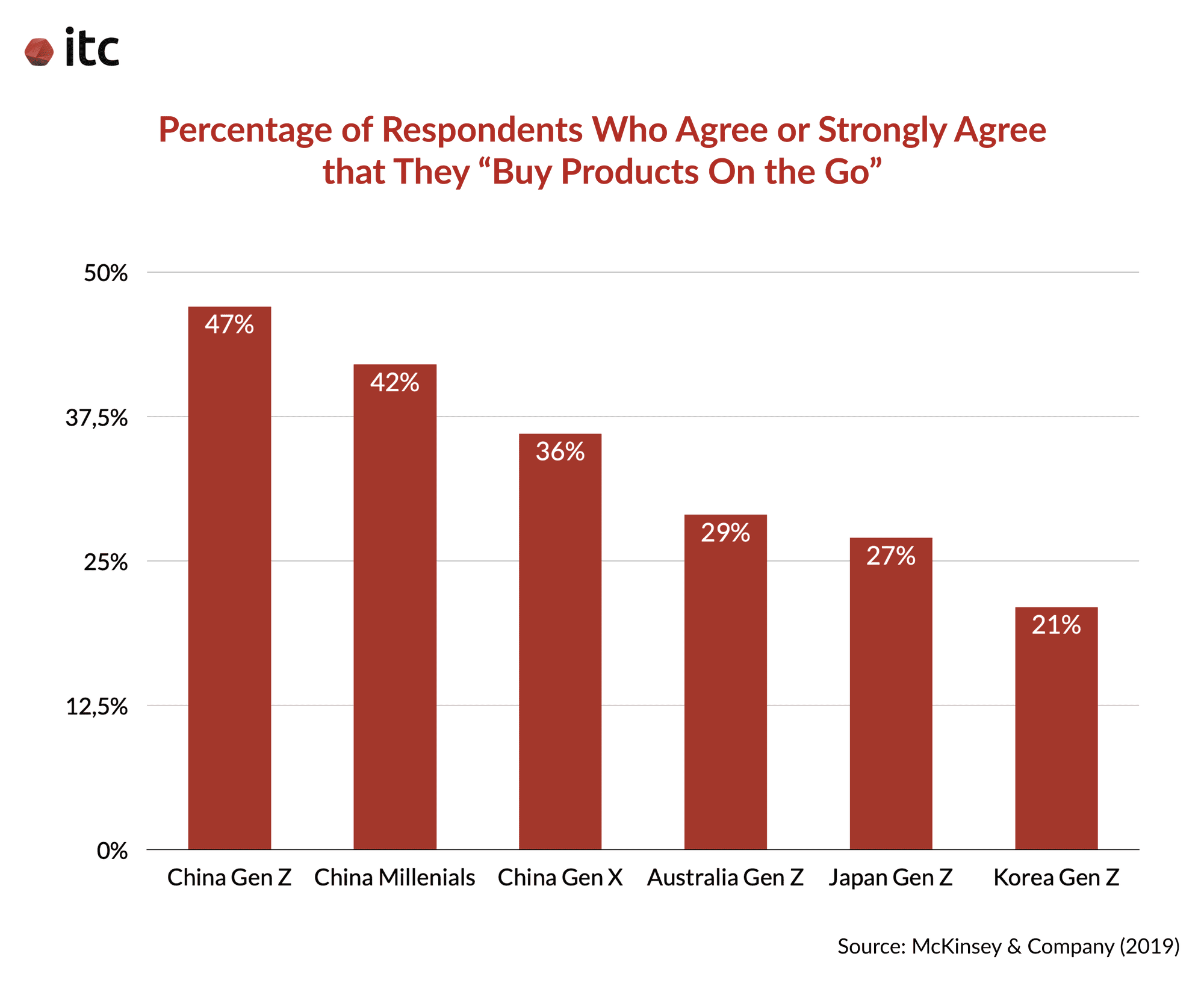

According to a McKinsey survey published in 2020, Chinese consumers can be very spontaneous, much more so than their peers in other countries. And the most impulsive out of the surveyed demographics are the Chinese Gen Z.

Moreover, these young consumers also have a higher tendency to go over their budget. In fact, the annual expenditure per capita on luxury goods of this group of youth is reportedly already on par with those of Gen X!

Nevertheless, at the same time, they are also very demanding about what their shopping experience should be like. They have a preference for:

- Social-fueled and technologically driven experiences over traditional settings

- Unique customizable products and services

- Loyalty to the brands they like/know

- Omnichannel shopping experiences

- Word-of-mouth recommendations

And these can be satisfyingly fulfilled by social commerce platforms in China like WeChat. Continue reading for a more detailed explanation below!

6 Elements of Social Commerce in China

Next, we will discuss the 6 main elements that brands need to understand and adapt in order to succeed in China.

1. KOCs & COLs vs KOLs

Who are KOLs in China?

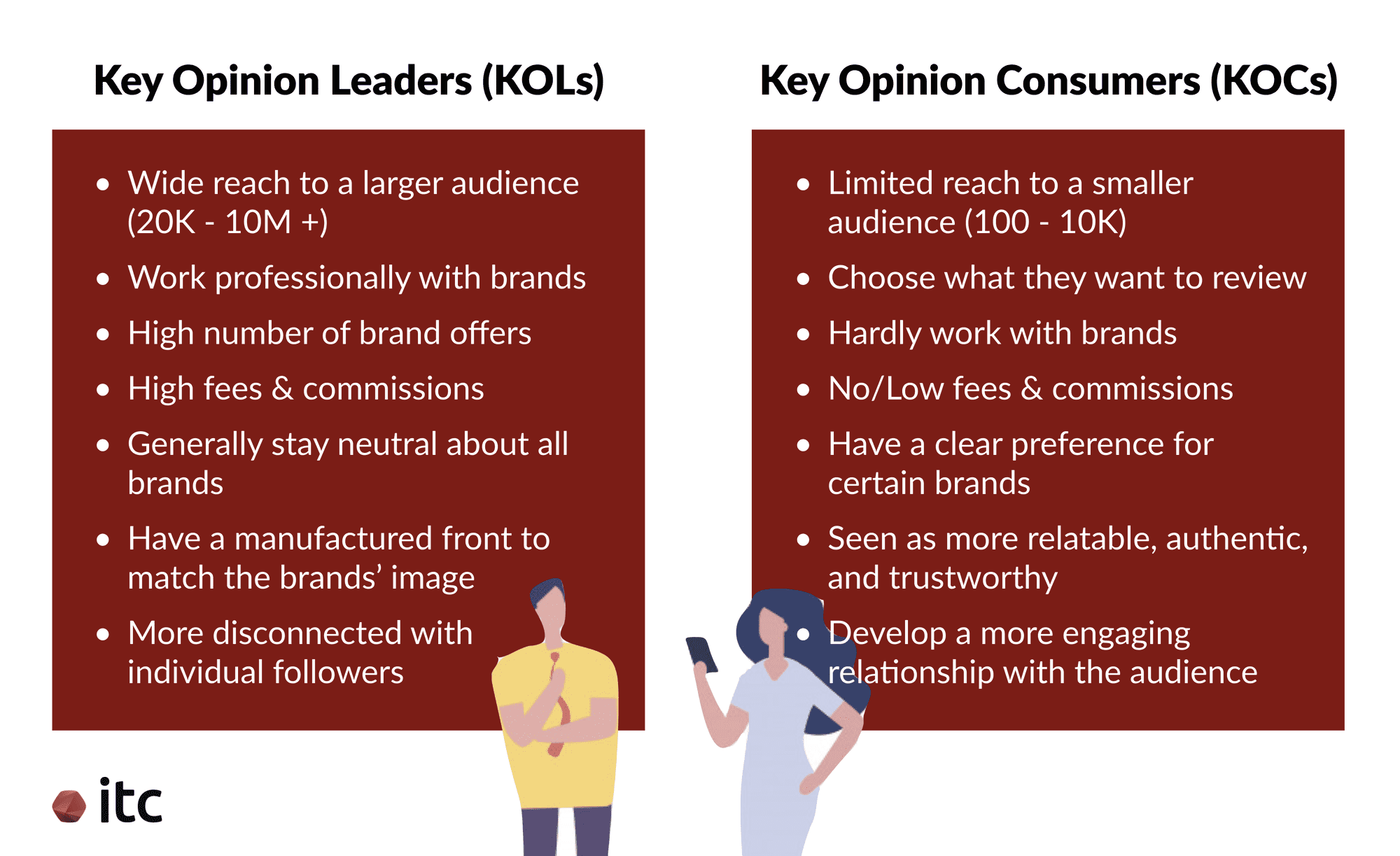

Key Opinion Leaders (KOLs) are celebrities, leaders, experts, or anyone with a large reach and influence due to their expertise and trustworthiness. One of their jobs is to share their opinions on a brand's product/service. This will prompt their followers to... follow in pursuit of the same values that the KOLs broadcast.

For a while, using endorsements from KOLs has been one of the best strategies to boost social commerce sales in China. With the rise of social media, the number of people following various KOLs over social platforms like WeChat, Weibo, Youku Tudou, etc. had spiked up.

However, a recent report published by Highsnobiety indicates that the age of influencer KOLs is likely coming to an end. The white paper revealed that the engagement rates for the top 50 traditional fashion KOLs on Weibo, WeChat, and Douyin have been stalling and diminishing since 2020.

This is likely the result of the "influencer fatigue" phenomenon, where users are losing interest in the opinions of KOLs. The disconnection with these Opinion Leaders arises from their over-saturation, manufactured appearance (inauthenticity), and dishonesty (e.g. non-disclosure of sponsored content).

Thus, the downfall of the typical influencers has paved the way for the rise of new generations of KOLs:

What are KOCs?

KOCs are Key Opinion Consumers. They are regular consumers sharing their opinions about a product/service on a social media platform.

So, technically, KOCs are KOLs in the way that they influence listeners' opinions. But the biggest differences here are:

- Anyone can be a KOC

- KOCs have a much smaller following than KOLs (up to around a few hundred to a few thousand)

- They do not work with brands very often and their fees and commissions are a lot lower

- KOCs decide what to review while KOLs tend to work with brands professionally

- They are seen as more relatable, authentic, credible, and trustworthy

- They develop a more personal and engaging relationship with their followers

Therefore, brands can partner up with KOCs to more accurately target a niche and benefit from these leaders' credibility and lower fees.

What are COLs in China?

COLs here are short for Cultural Opinion Leaders. They are what Highsnobiety calls "the next generation of KOLs".

COLs are the future leaders of digital trends. This includes adopting new social media sites and pioneering digital movements that match their core values and beliefs. Their credibility and authority are derived from their authenticity and cultural intelligence and experiences. This is opposed to the manicured front of many KOLs to show off affluence or social status.

And, as you can probably tell, this generation of creative, innovative, and self-aware KOLs are mostly Gen Z. They focus on cultivating niche communities on emerging social media platforms such as Xiaohongshu, Bilibili, and Poizon. Here, they can be honest, personal, and even vulnerable in front of their audience.

In addition, COLs are also the main driver of the "Guochao" trend. The trend encourages consumers to buy "Made in China" products and foreign brands that celebrate Chinese values.

To sum up, brands should start leveraging the power of this highly creative, driven, and culturally conscious group of KOLs and their engaging niche communities, instead of the same over-saturated group of traditional KOLs.

2. Live Commerce

Live commerce is another important aspect of the eCommerce market in China. It refers to the combination of live streaming and eCommerce and can take place on any digital platform, including social media channels.

Although livestream eCommerce had been around since 2016 when Alibaba introduced Taobao Live, the recent COVID-19 pandemic definitely boosted its growth to a whole new level.

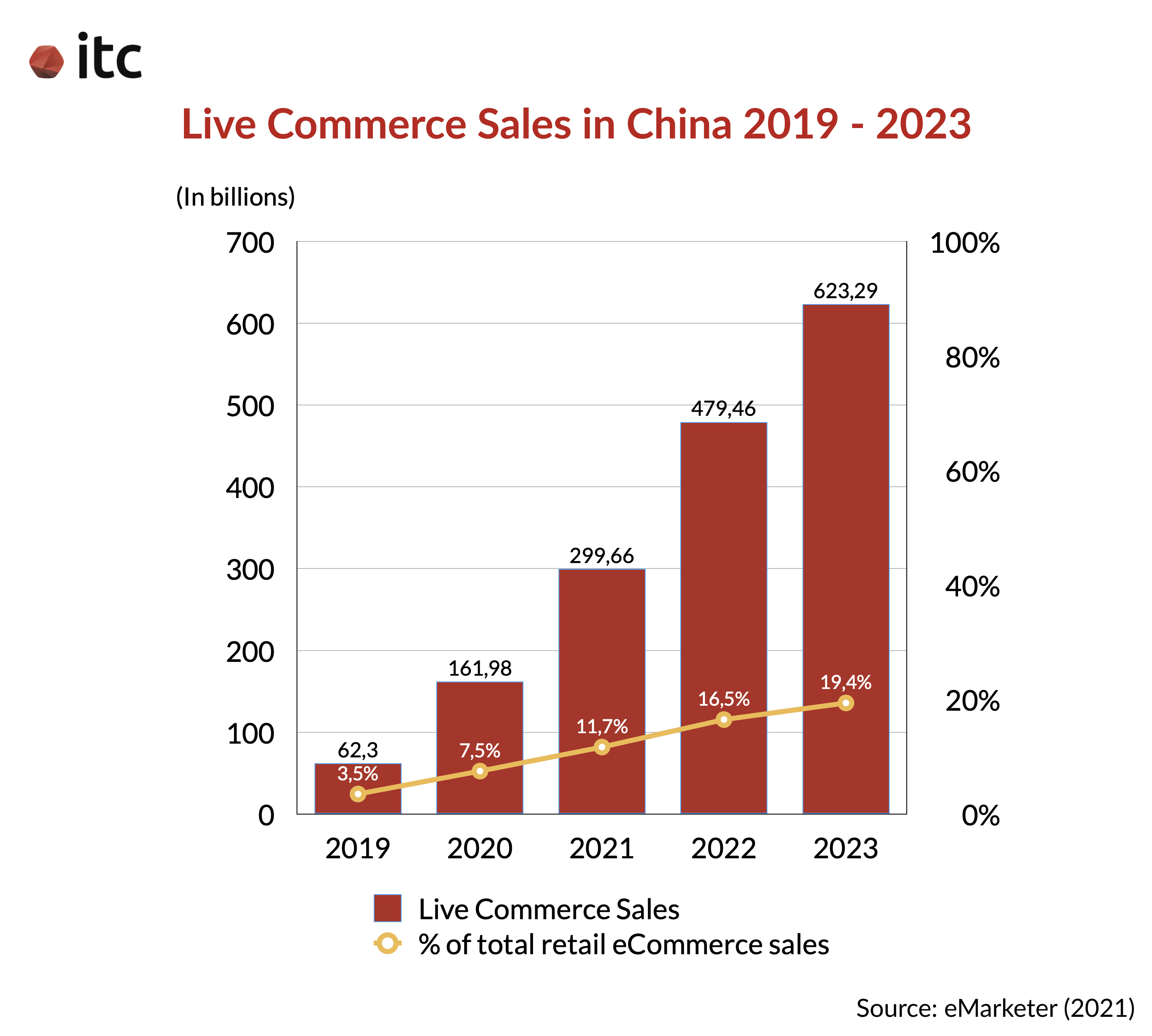

According to eMarketer, China's live commerce sales saw an upsurge from around $62 billion in 2019 to nearly $300 billion in 2021, contributing 11.7% to the country's total retail online sales. By 2023, this figure is projected to continue steadily increasing to 19.4%.

One of the top-performing social commerce platforms in the Live Commerce space is Douyin. Known internationally as Tiktok, this short video social media channel also has a live streaming feature for brands to directly engage with the users in real time. In 2020 alone, Douyin generated 381.2 billion yuan (over $56 billion) from live commerce. This was nearly 1/3 of the entire sector!

And, one of the most notable examples of successfully utilizing live streaming on Douyin is PEACEBIRD. From September 2020 to January 2021, the Chinese fast fashion brand reported its average growth rate of monthly Gross Merchandise Value (GMV) was as high as 78%!

Aside from Douyin, WeChat - the biggest social media platform in China - is also becoming a key live-streaming tool. The cosmetics brand Perfect Diary revealed in 2020 that the conversion rate of its WeChat Mini Program live streams was 2 - 3 times higher than any other platform!

3. Product Customization

Another great tactic brands are using is allowing product customization via social commerce platforms in China.

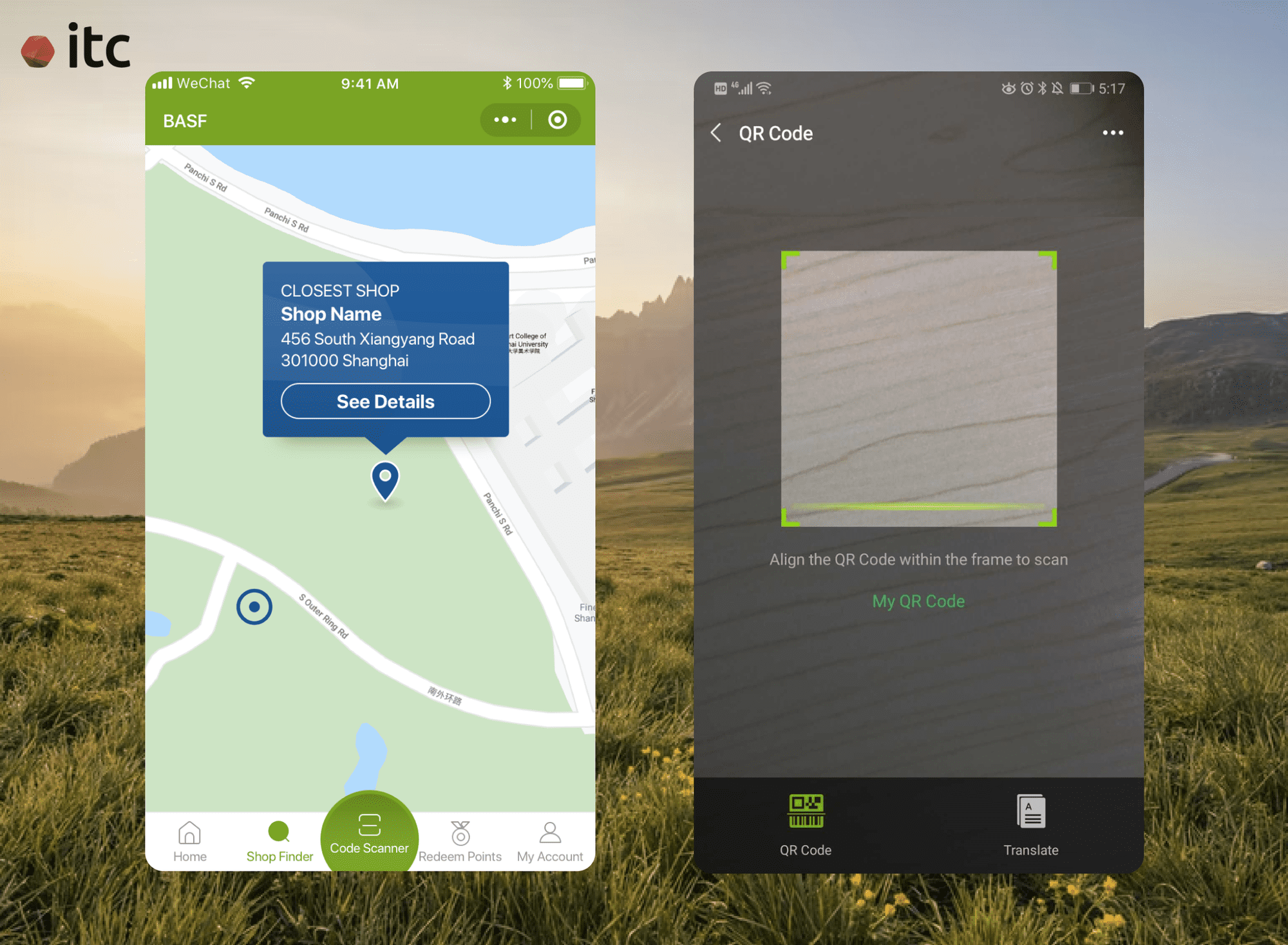

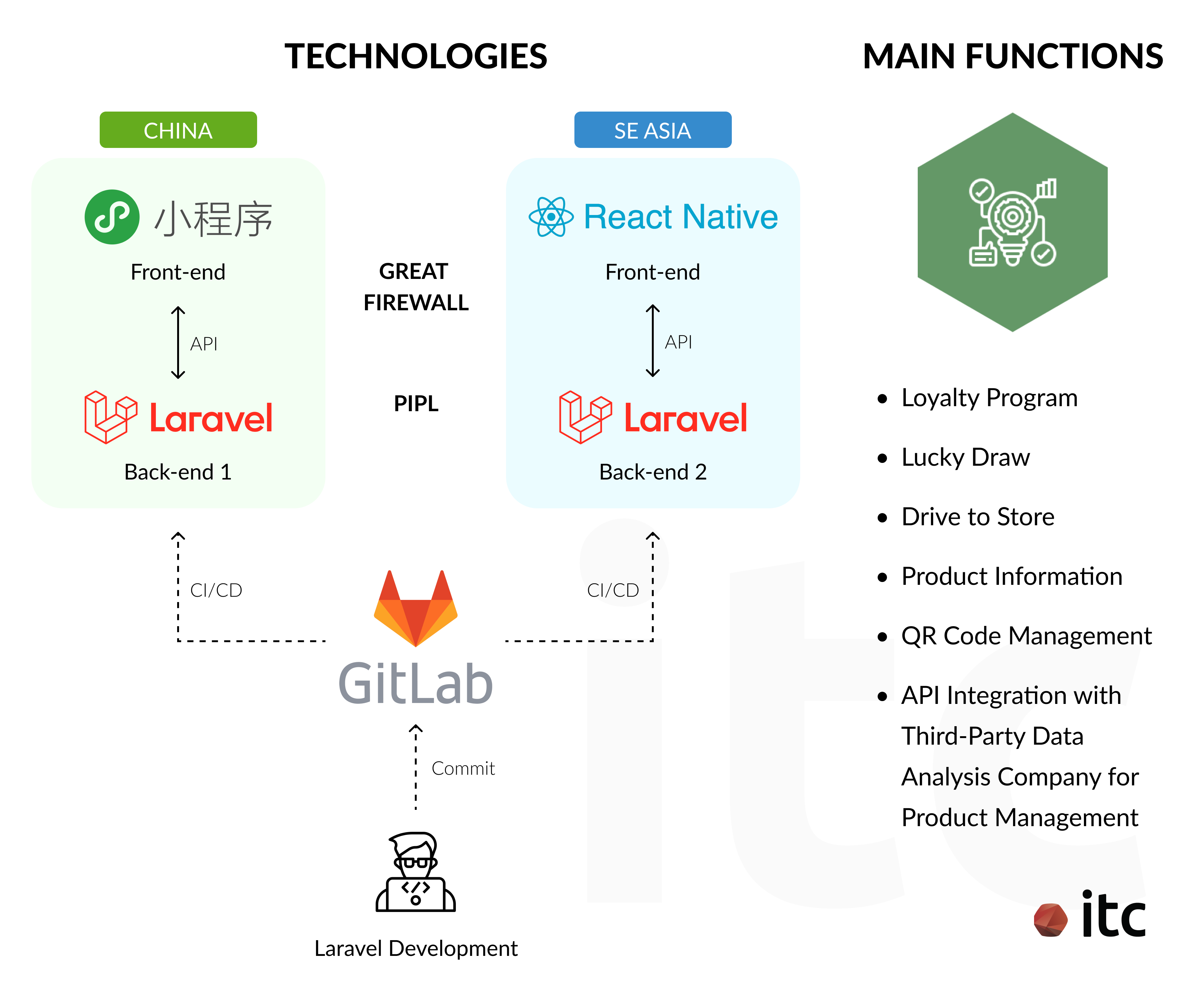

For example, at IT Consultis (ITC), we crafted a tailor-made WeChat Mini Program for BASF to elevate the customer experience of local Chinese farmers. Its features include calculating their product usage and personalizing recommendations for each farmer.

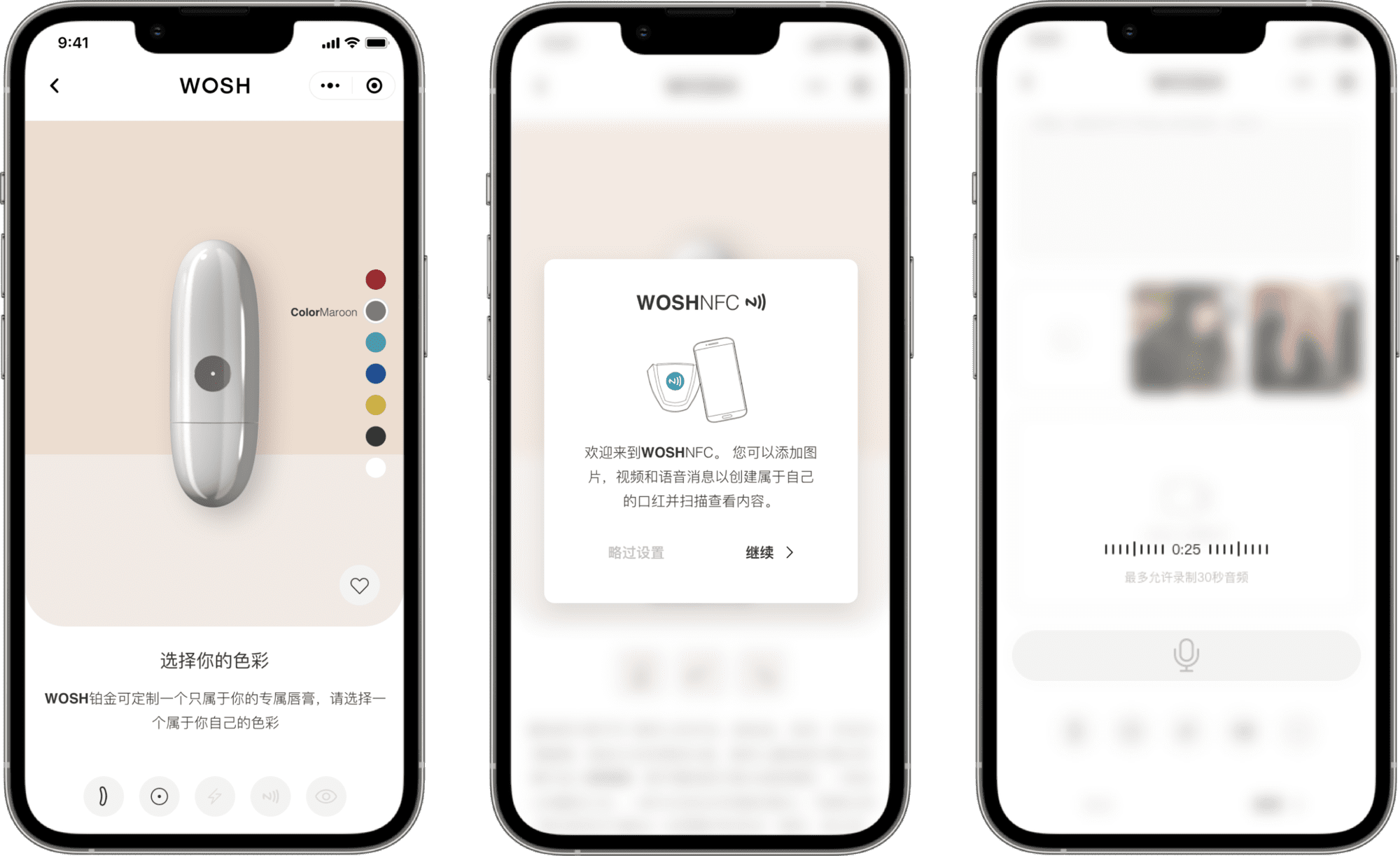

In addition, ITC has also leveraged NFC (Near Field Communication) technology in the Mini Program for the cosmetics brand Yizhiji to deliver a unique user experience. In particular, this feature enables Yizhiji to engrave its lipstick cases with personalized messages, such as texts, images, videos, or even vocal recordings!

4. Omnichannel Experience

With a plethora of both online and offline touchpoints, brands in China are maximizing their gains and enhancing customer experience by implementing end-to-end omnichannel strategies. More specifically, they are focusing on bridging seamless multi-device and online-to-offline (O2O) pathways, including developing omnichannel loyalty programs.

For instance, the BASF Mini Program also effectively facilitated O2O moves for its target market. Chinese farmers can utilize:

- The straightforward QR code technology to accumulate points from in-store purchases

- The interactive map to find the nearest physical stores

These are very common features to incorporate in brand MPs for a smooth O2O move. In fact, the Mini Program of Pirelli, also came with a dynamic Retailers Locator. This function helped direct customers to the nearest physical stores for further research and even conversion.

With regards to multi-device optimization, one of our recommended approaches is using a headless architecture. This technique separates the frontend from the backend. Thus, brands can have just 1 backend that can support multiple "heads" for multiple digital platforms.

As a result, they can benefit from a more efficient content management process. At the same time, users can enjoy a more consistent experience across different private channels.

Back to our BASF example. Other than the MP for the Chinese market, ITC also created a Hybrid app with ReactJS for the Southeast Asian market. And both of these platforms were connected headless to the backend framework Laravel.

5. Social CRM

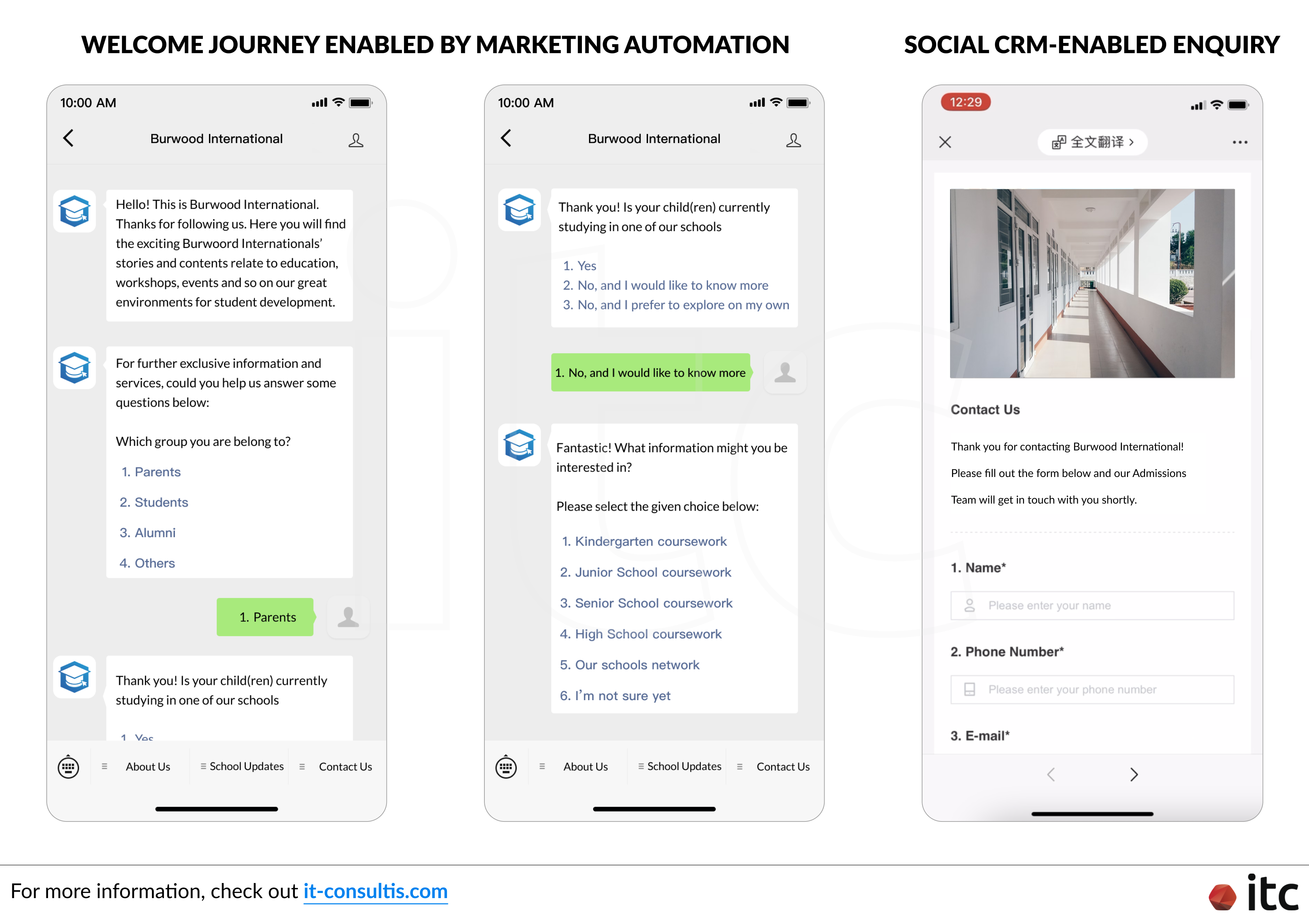

Marketing Automation and Social CRM (SCRM) frameworks in China can help brands better target and retarget users with a more personalized experience on WeChat and gain deeper insights to drive data-driven decision-making. Brands can fully utilize them to:

- Connect with their target market

- Improve their understanding

- Develop strategies

- Boost ROI

This is especially the case in China, where social media has become an almost inseparable part of everyday life.

A leading International Education Group has implemented Marketing Automation and Social CRM strategies for both the Brand level and individual Schools. By leveraging Social CRM frameworks, tagging strategy for building holistic user profiles, personalized engagement content, and more, the International School in China could:

- Improve lead generation and management

- Enhance data ownership and generate data-driven insights

- Deliver a consistent O2O user experience

- Build more effective and evidence-based marketing strategies

- Empower communication with different school communities, including prospective parents, students, and job seekers

- Maximize synergy across all schools' platforms

As a result, the Education Group witnessed a remarkable increase in the enquiry submission rate (lead generation)!

6. Gamification

Several brands also implement gamification campaigns on WeChat to engage users directly with the brands. Games allow users to connect with brands, earn discounts or coupons, and even gain valuable information on the products/services they offer.

A notable gamification project is developing Porsche's campaign on WeChat. We helped the premium German automobile brand launch a racing game with maintenance stations along the way to power users' education on car maintenance. Basically, the more milestones they reach, the more they can learn about maintenance for their own Porsche cars.

And, once the user completes the fun and interactive educational journey, they can earn exclusive gifts, such as a discount for their next maintenance.

The Interconnection of Tech Giants - Future Social Commerce Growth in China

China's digital landscape is mainly dominated by 2 tech giants - Alibaba and Tencent. And for a long time, they have been minimizing interactions by blocking each other's links and services, causing inconveniences for users.

For example, links to Alibaba Tmall and Taobao when shared on WeChat could not be directly accessed. Instead, users had to manually copy the link and paste it onto another platform for the links to work.

However, the Authorities have been pushing for interconnection between these tech giants to improve the country's digital ecosystem and reduce monopolistic competition.

As a result, the conglomerates have been taking small steps to work with each other and bring a better user experience in all aspects of e-Commerce, including social commerce. This includes:

- Alibaba starting to accept Tencent's payment method WeChat Pay in September 2021

- Tencent's WeChat enabling direct access to Alibaba's Tmall and Taobao via link sharing in private one-on-one and group chats in November 2021

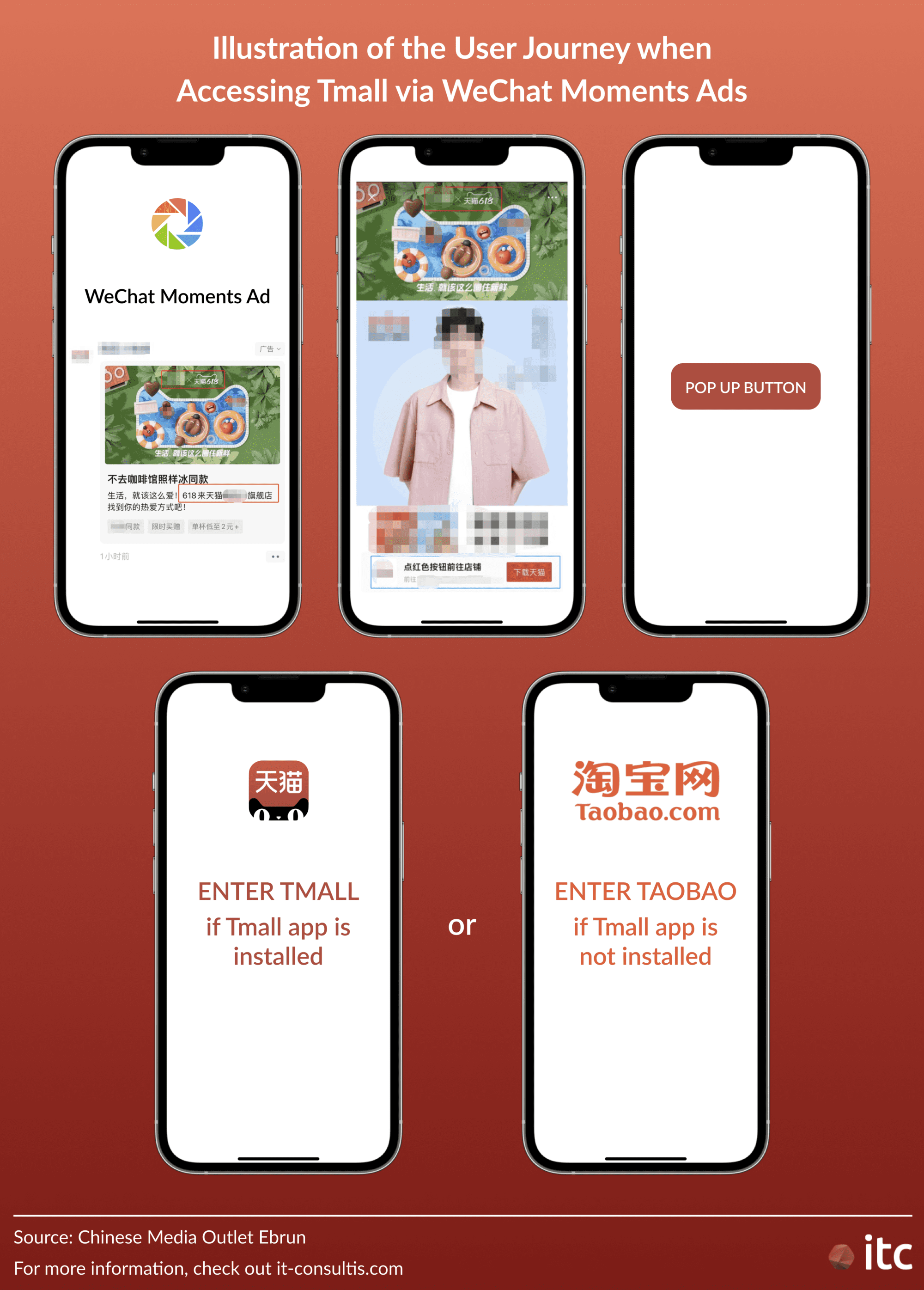

- Tencent's WeChat allowing Tmall links to be shared and accessed via Moments Ads for the 618 Shopping Festival in June 2022

Going forward, we can expect to see more moves to interconnection among these dominating tech giants. And a more diverse and integrated digital ecosystem should transform social e-Commerce in China even further.

To Wrap Up

The social shopping ecosystem in China has evolved greatly and is still changing rapidly day by day. Therefore, it is extremely important for all businesses to adapt, diversify, and adopt the best social commerce strategies to drive more private traffic and achieve the maximum ROI.

Need help joining the social commerce race in China and Asia?

IT Consultis is a digital transformation consultancy based in Shanghai. We are specialized in China and Asia markets in:

- Leveraging Social CRM tools and developing Marketing Automation journeys

- Developing tailor-made digital enablers, including WeChat Mini Programs and websites

- Integrating all digital systems to streamline data circulation for more in-depth data analysis

- Building innovative omnichannel loyalty strategies fully integrated into your assets

Send ITC a message to start crafting the best eCommerce enablers and Social CRM strategies!

FAQs

What is Social Commerce in China?

Social commerce is the process of promoting and selling products/services via social media channels. China's social commerce market is the most developed in the world, leading the trend of blurring the lines between eCommerce and social media.

What are the Leading Commerce and Social Media Platforms in China?

The current top 5 social commerce platforms in China are:

- Xiaohongshu (Little Red Book)

- Guangguang (Taobao/Tmall)

- Pinduoduo

Is Taobao a Social Commerce?

Yes, Taobao can be considered to be a social commerce platform as the social shopping function Guangguang has been integrated with this Alibaba's C2C platform in 2021.

Does China Allow Social Media?

Yes. Although popular global social media platforms like Facebook and Twitter are blocked, Chinese people can still make use of domestic channels.

Why is Social Media Popular in China?

The reasons are the same everywhere:

- Easy to use

- Allow users to connect with like-minded communities

- Spark creativity in content creation and sharing

- A cost-effective way for brands to connect with their target customers

What is the Most Used Social Media in China?

WeChat is the most used social media in China. By 2022, WeChat has gained over 1 billion monthly active users.