Blog/Clienteling/Beyond the Transaction: The Psychology of Clienteling in China

In this article, we’ll explore the latest insights shared by Laura Pan – Lecturer on Luxury Strategy, Tech, and Chinese Consumer Behavior at SDA Bocconi, as she uncovers how luxury brands in global markets and China are adapting their clienteling strategy to market shifts, drawing on her expertise in luxury strategy and Chinese consumer behaviors.

Table of Contents

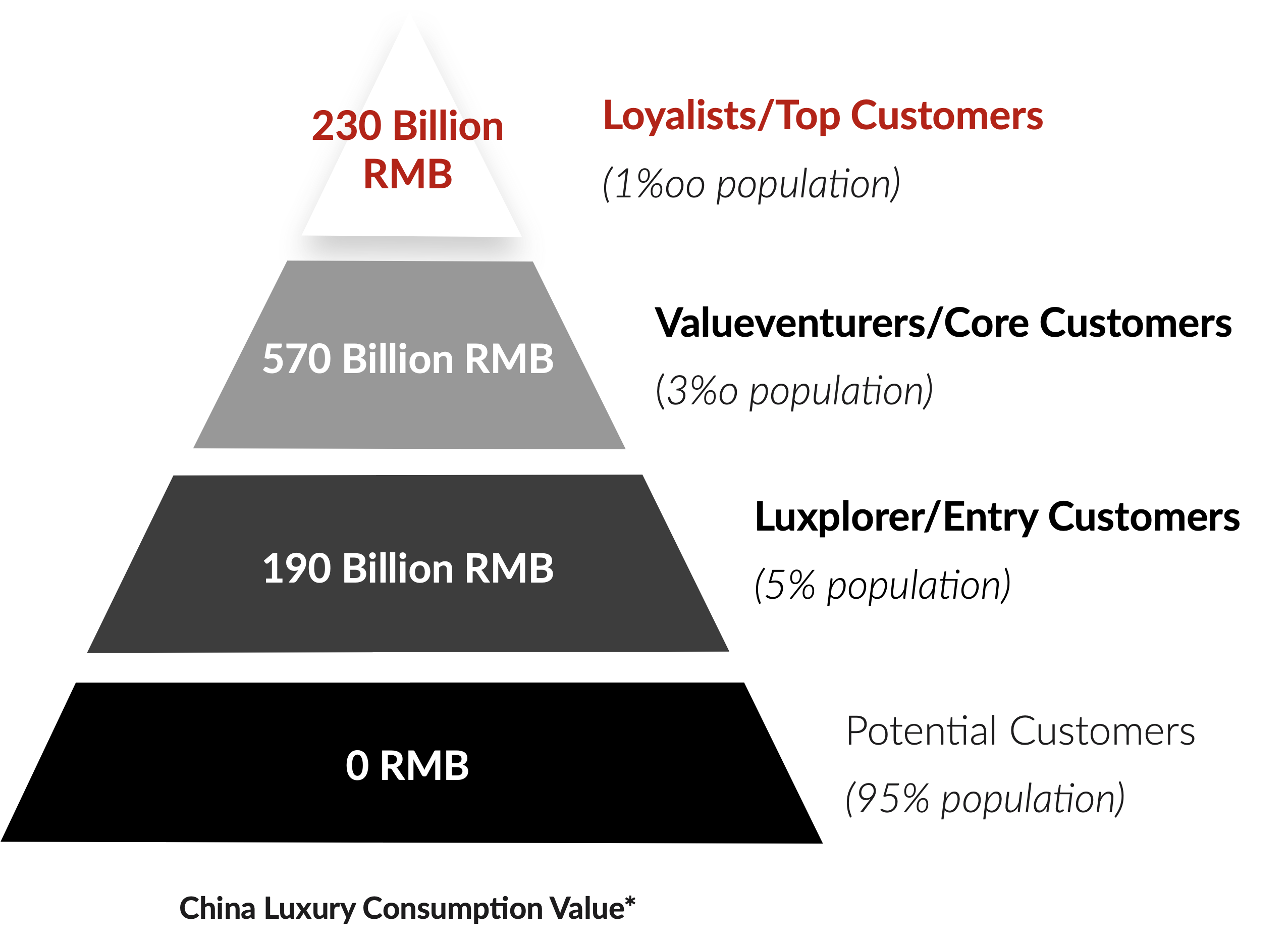

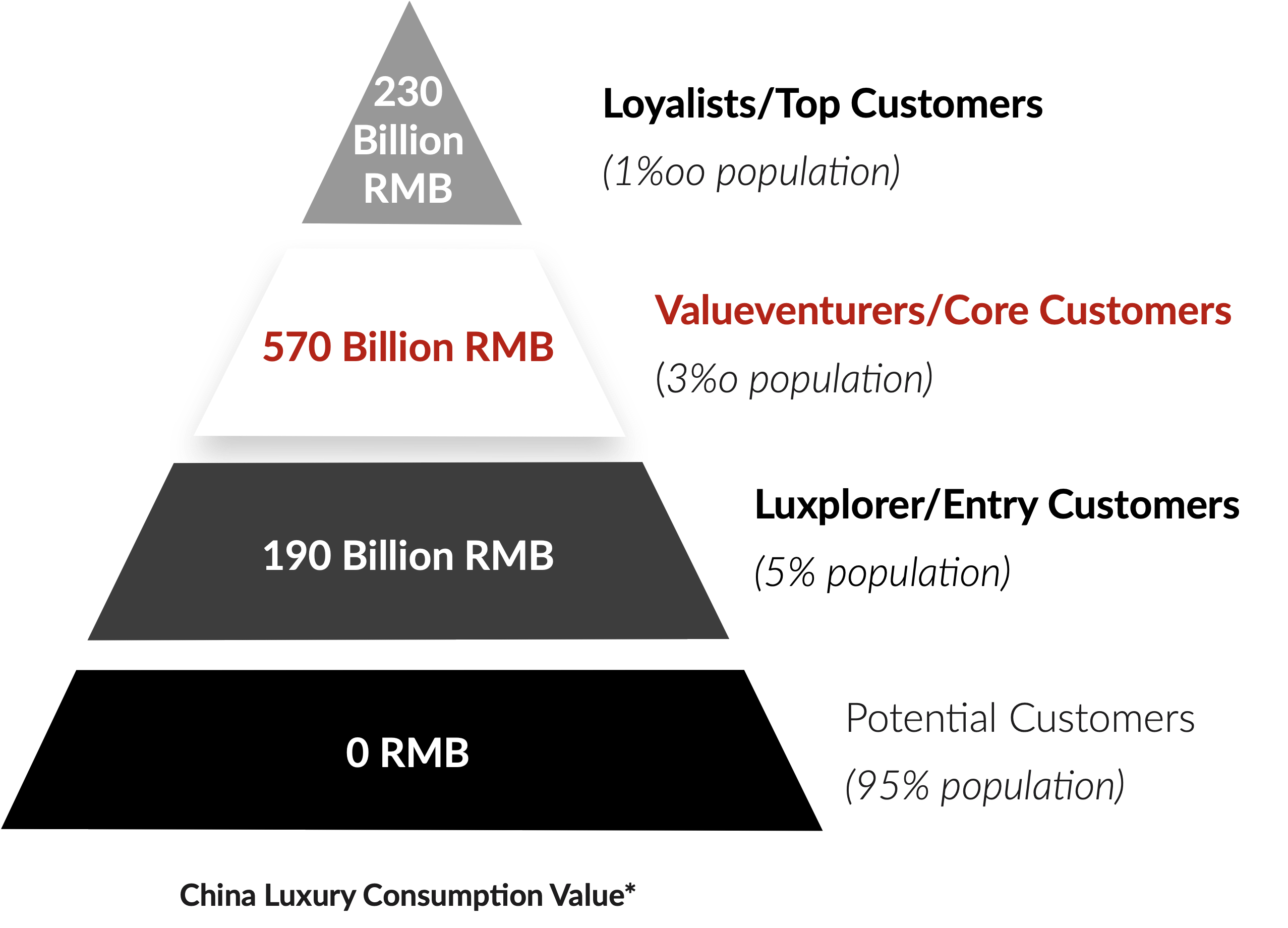

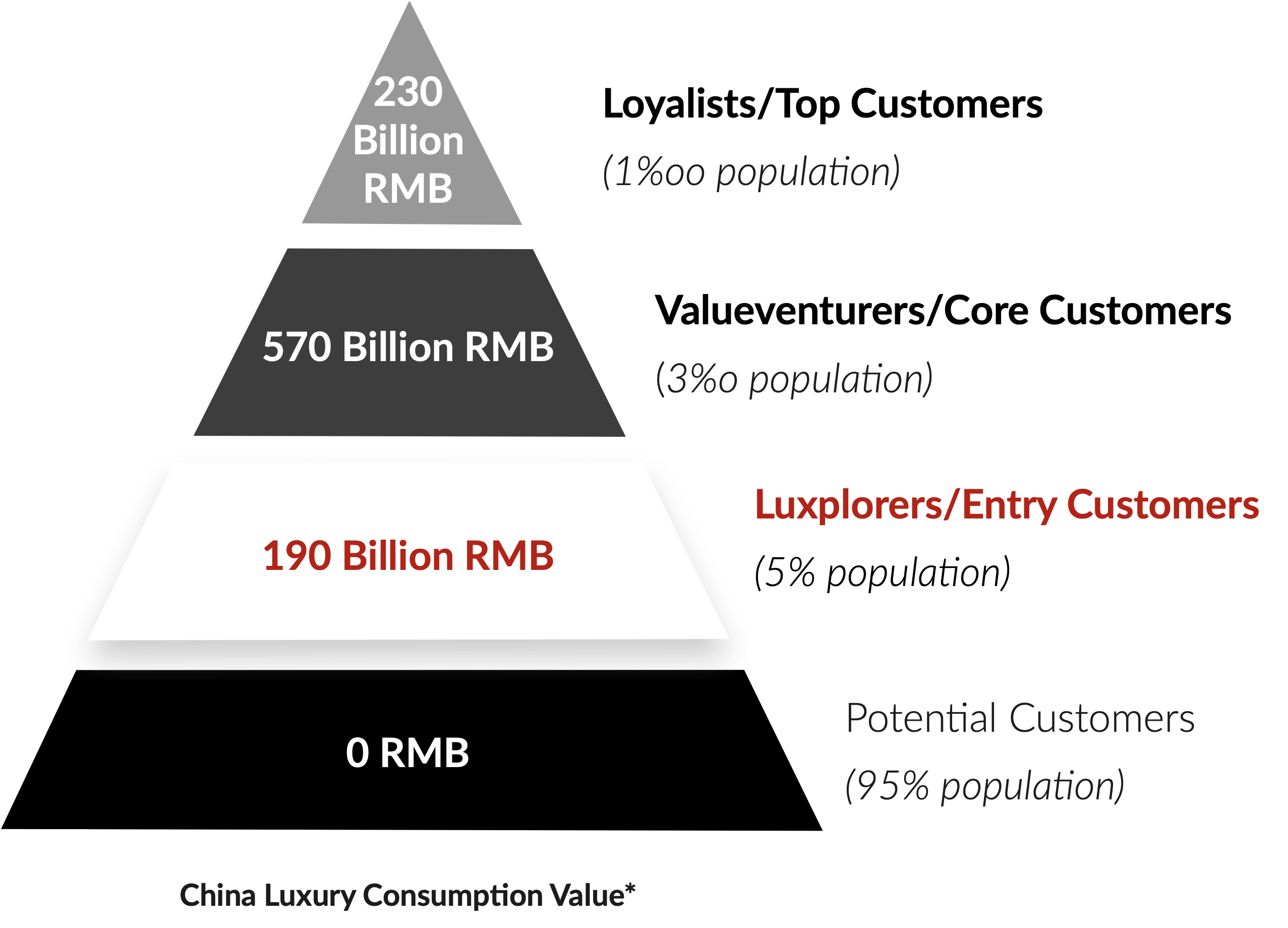

Chinese Luxury Consumer Archetypes

When it comes to Chinese luxury consumers, there are generally three archetypes that luxury brand CRMs can identify. Each of these archetypes has distinct behaviors regarding how, where, when, and why they shop, as well as who they build relationships with.

1. Loyalist

The Loyalist represents a highly sophisticated luxury consumer with a long history of purchases across various luxury brands. Typically aged 35 and above, these individuals fall into the Ultra High Net Worth (UHNW) category.

How They Shop

Loyalists are discerning buyers who prioritize product design, functionality, and style over fleeting trends.

They make purchasing decisions based on whether an item truly embodies the quality and uniqueness they value. Price is not a deterrent but rather a metric for value—if a piece doesn’t showcase the brand’s iconic design or unique attributes, it simply isn’t worth their investment.

Service is another critical factor. For the Loyalists, how they are treated throughout their customer journey is often more crucial than the product itself.

They won’t hesitate to walk away from a purchase, even if it’s a rare or exclusive item if the service experience falls short of their expectations.

Where They Shop

True to their name, Loyalists are deeply committed not just to a specific brand or store, but to their personal sales consultant.

No matter where they are, they prefer to engage with the same consultant, often using personal chat platforms like WeChat, Line, or WhatsApp to maintain this relationship. For example, if a Loyalist’s home store is in Plaza 66 but they are currently in Singapore, they will likely reach out to their consultant at home rather than engaging with a new one.

This loyalty stems from their comfort with familiar consultants, the personalized service they receive, and a desire to ensure that commissions go to someone they trust. They only deviate from this pattern when convenience, such as the immediate availability of a desired item, outweighs their principles.

When They Shop

Loyalists are not bound by sales cycles or holiday promotions. Whether it’s Qi Xi Festival, Golden Week, or Chinese New Year, they shop whenever the mood strikes, often making spontaneous purchases driven by a desire for something truly exceptional.

Why They Shop

While Loyalists may not be devoted to a single brand, they do maintain a curated selection of favorites.

However, their brand loyalty is fluid, influenced by changes in personal style and the evolution of brand offerings. Their allegiance is to quality, uniqueness, and design, and as these factors shift, so too might their brand preferences.

Who They Shop With

The relationship with their sales consultant is the cornerstone of the Loyalist’s shopping experience. A strong, personalized connection increases the likelihood of repeat purchases from the brand, while a more superficial relationship translates into a transactional, convenience-based interaction with little to no loyalty.

The depth of this relationship often dictates not just where, but also how frequently, they choose to shop.

2. Value-venturer

The Value-venturer is a sophisticated luxury consumer with high disposable income but a keen eye for maximizing value. Aged between 25 and 40, this group, which includes millennials and Gen Z, forms the majority of luxury consumers in China. Despite their significant purchasing power, they are not classified as Ultra High Net Worth (UHNW) individuals.

How They Shop

Value-venturers are strategic and calculative in their purchasing decisions, often chasing discounts, promotions, and opportunities for price arbitrage. They are opportunistic shoppers, choosing the right time and place to make purchases that offer the best value.

Unlike the Loyalists, they are willing to switch sales consultants or stores, both locally and internationally, if it means accessing better deals or exclusive offers, such as sales campaigns, invite-only events, or significant discounts.

Where They Shop

This archetype is flexible and open to shopping in different locations, frequently making purchases abroad to take advantage of better prices.

While they may build relationships with local sales consultants, their loyalty is mid to low, easily swayed by better value propositions from other consultants or stores.

When They Shop

Their shopping behavior is not tied to specific seasons or promotions, as they are always on the lookout for opportunities to maximize value.

They are highly responsive to sales periods and other value-driven shopping occasions.

Why They Shop

The primary motivation for the Value-venturer is securing the best deal. Their shopping choices are driven by the desire to make smart, value-oriented purchases rather than by brand loyalty.

Who They Shop With

Value-venturers are not particularly loyal to a specific sales consultant. They prioritize value and are willing to adopt new consultants if it means better service or access to exclusive deals.

This makes them one of the most challenging groups for brands to engage in long-term, loyal relationships, especially when trying to drive local clienteling efforts to reduce overseas consumption.

3. Luxplorer

The Luxplorer represents a consumer who is relatively new to luxury consumption. Typically, under the age of 27, Luxplorers are occasional luxury shoppers without established relationships with luxury brands or sales consultants.

How They Shop

Luxplorers are still in the exploratory phase of their luxury journey, highly influenced by trends and social media. Unlike more seasoned consumers, they have no strong brand loyalty and are more focused on discovering what the luxury market has to offer.

While they are not as savvy or price-sensitive as the Value-venturer, their inconsistent disposable income leads them to prefer lower price points. However, they generally do not go out of their way to hunt for deals.

Where They Shop

Luxplorers are not tied to any particular brand or store, making their shopping behavior unpredictable. They are more likely to experiment with different brands and stores, often driven by trends rather than long-standing preferences.

When They Shop

Their shopping habits are sporadic and influenced by trends or social events. They do not have a regular luxury shopping routine and are less likely to make frequent high-value purchases.

Why They Shop

Luxplorers are motivated by the desire to explore and experience luxury, often driven by the influence of trends, peers, and social media. They are less concerned with the long-term value of their purchases and more interested in the immediate gratification and status that comes with owning luxury items.

Who They Shop With

Building relationships with Luxplorers is challenging for luxury brands. While marketing activations and experiences can attract their attention, converting them into loyal customers is difficult due to their lack of commitment to any single brand.

Clienteling in China vs The West

Inquiries & Availability

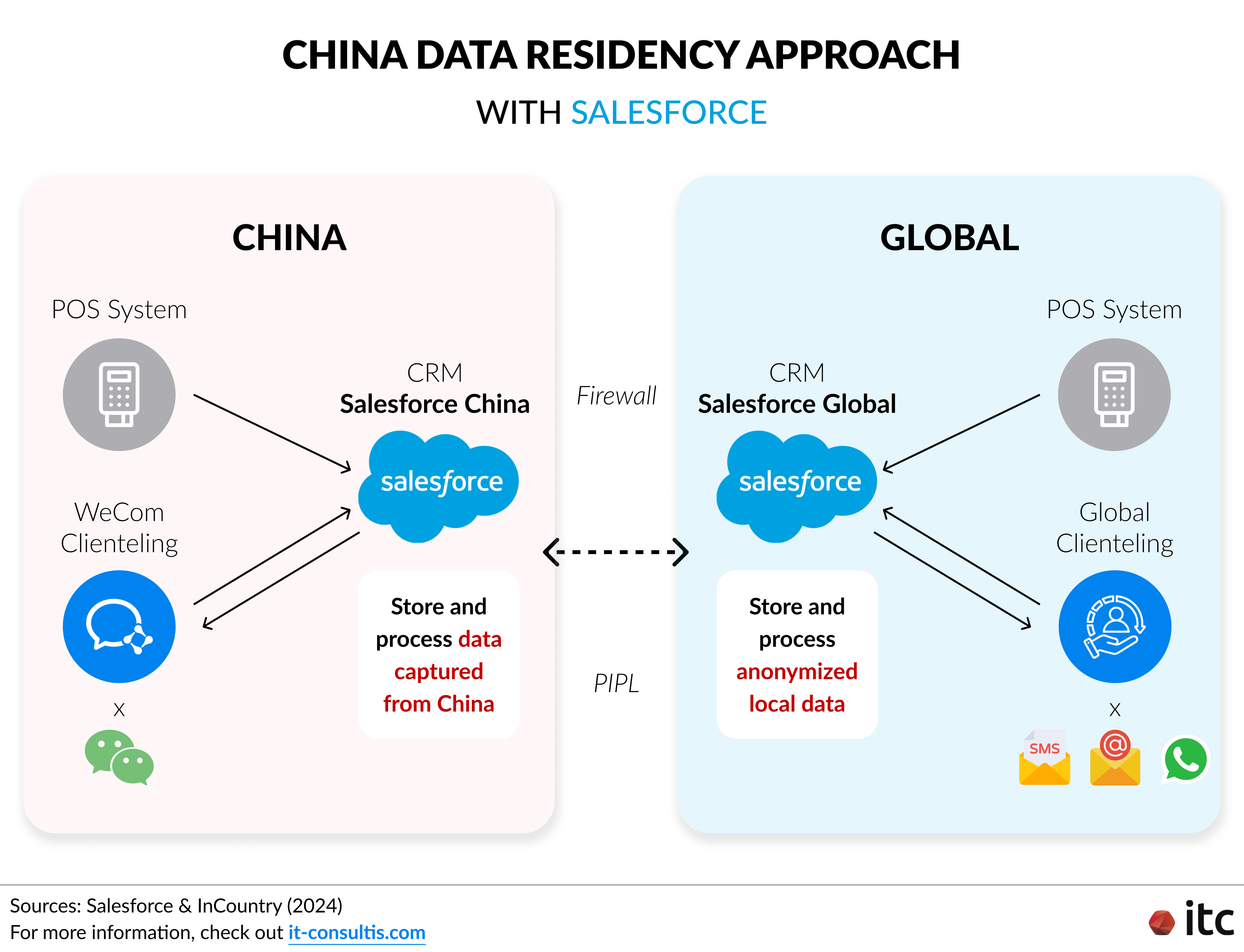

In China, the primary platform for client engagement is WeChat, integrated with WeCom, which allows brands to manage client relationships even when sales consultants are unavailable.

Chinese sales consultants are typically available 24/7, responding quickly to inquiries, driven by a strong desire for success, commission, and maintaining impeccable service.

In the West, sales consultants are generally advised to keep client communications on work devices, not personal mobiles, to ensure that all interactions remain within company systems.

In Europe, work devices must be left at the store after shifts, meaning consultants cannot attend to client inquiries outside working hours. Only top performers, often ethnically Chinese consultants, may retain their work mobiles to serve demanding high-spending clients.

Client Activation

In China, it is common for sales consultants to request a WeChat connection even if the customer doesn’t make a purchase. Chinese consultants are proactive in following up post-visit to keep the client engaged.

WeCom allows for immediate sharing of client information, integrating it into the CRM database. WeCom Moments provides passive engagement, unlike WhatsApp, offering updates on events, collections, and celebrations.

According to Valentino’s CRM Manager, client contactability in China is around 97%, compared to 70% – 80% in Europe and the U.S., with some European brands seeing as low as 50% contactability.

In the West, there is generally no culture of following up with clients added to WhatsApp. Communication tends to be more client-initiated rather than consultant-driven post-visit activation. Client information is rarely stored in the CRM database, missing opportunities for data collection.

Despite growing mobile accessibility in the West, platforms like WhatsApp, Line, and Kakao lack features for effective passive engagement.

Omni-Selling

In China, most luxury brands in China keep their e-Commerce and retail CRM systems separate, leading to divided omnichannel purchase histories between online and offline sales. This separation often results in inconsistent customer experiences between e-Commerce clients and in-store interactions.

The competition between e-Commerce and retail divisions also raises issues of client ownership and activation rights.

In the West, Western luxury brands typically maintain a unified CRM database, where all customer interactions—whether in-store, online, or via phone—are registered under the same profile. This ensures a consistent experience across channels.

The exception lies in purchases made through wholesale channels with no direct brand relationship, such as Mytheresa.com or Farfetch.com, where customer data may not be integrated into the brand’s CRM.

The Shift in Luxury Consumption (Snapshot)

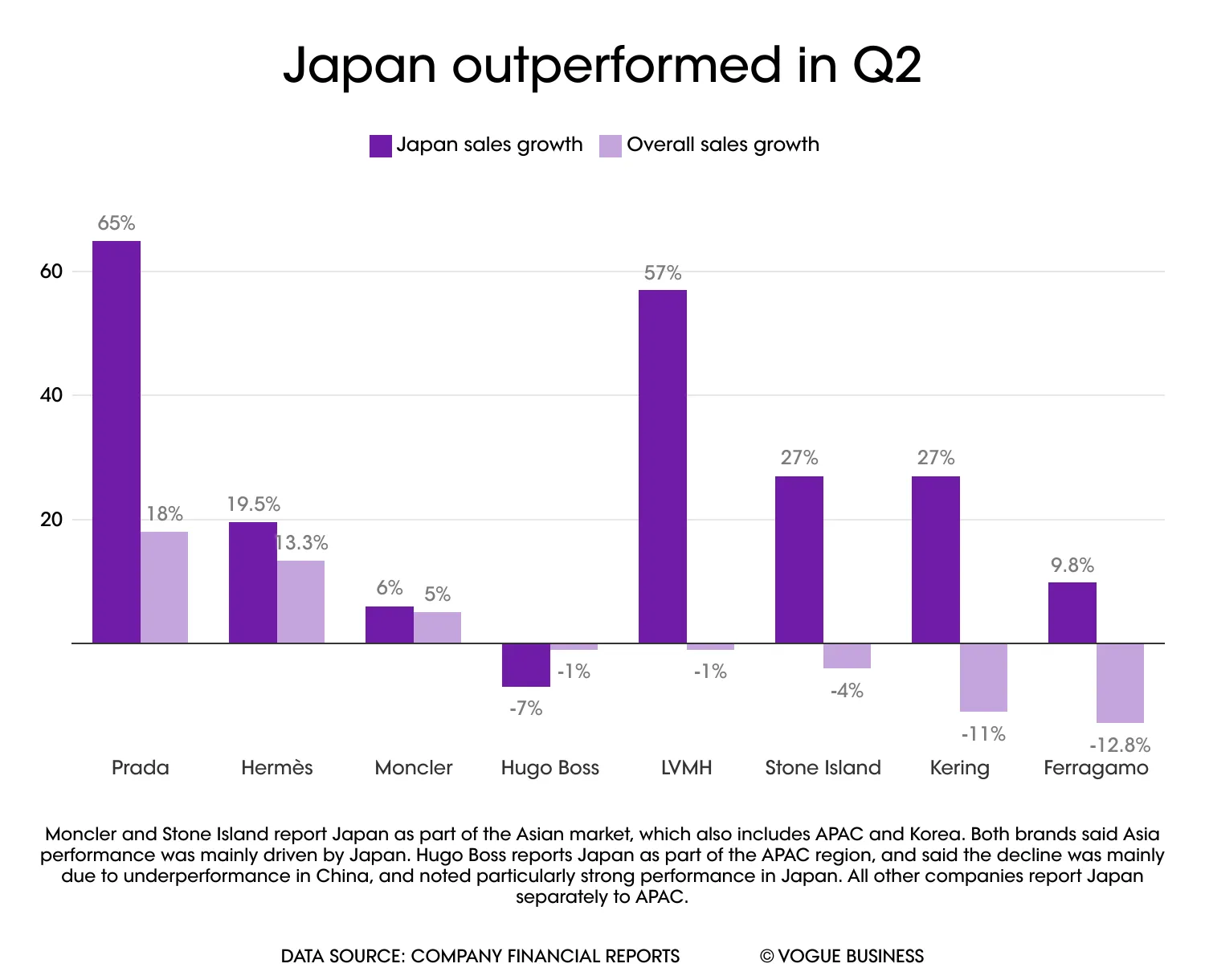

Chinese luxury consumption has noticeably slowed, as highlighted by various media outlets, and this trend became even more apparent after luxury houses released their mid-year financial results in July 2024.

Both LVMH and Kering reported significant revenue declines from Asia Pacific (excluding Japan), with LVMH seeing a 4% drop and Kering a 5% decrease. While it’s suggested that these sales have shifted to other markets like Japan and Europe, this shift seems evident only for Japan and not for all brands.

Japan has long been a favored travel destination for Chinese tourists, even before the pandemic and the depreciation of the yen. The weak yen further encouraged savvy Chinese shoppers to take advantage of favorable exchange rates.

However, Japan’s appeal as a market goes beyond just currency advantages: it offers excellent service, great food, and ease of travel. For instance, a Japan travel visa, valid for five years, costs only RMB 475, while European visas are often expensive and not guaranteed.

Several factors contribute to the changing luxury consumption landscape:

Post-COVID Travel Confidence Recovery: Chinese consumers are increasingly leaving the mainland to seek unique experiences and enjoy local cuisines, spending their money abroad.

Luxury consumption hasn’t been the primary focus of overseas travel since as early as 2018, reflecting a continuation of pre-COVID behavior among luxury consumers.

Stagnation in Luxury Brands’ Creativity: Many luxury brands are becoming less innovative and more repetitive.

For example, Dior continues to produce the same silhouettes with different patterns. Fashion critics have voiced dissatisfaction with the uninspired designs from Kim Jones at Fendi and Sabato de Sarno’s Gucci, which seems to be caught between old Gucci and current Prada.

Opportunistic Pricing Strategies: Between 2022 and 2023, luxury brands raised prices significantly, to the point where they priced out many Chinese luxury consumers.

Previously, the upper middle class drove luxury consumption with low-value, high-volume purchases. Now, even wealthy and sophisticated consumers are resistant to these new price hikes.

For instance, customers have noted that a current €3000 Prada skirt looks nearly identical to a Prada skirt from 10-20 years ago, which was available at a fraction of the price. This has led to a preference for hunting vintage pieces over buying new items.

Nonetheless, recent developments have revealed a shifting outlook: Europe has seen a remarkable surge in interest from Chinese travelers:

- 105% increase in bookings for Paris by Chinese travelers between late July and early August

- 65% YoY increase in average spending per Chinese traveler on five-star hotel bookings

- 81% of Chinese shoppers plan to visit Europe in the coming months

- 111% increase in Chinese travelers to Italy in June 2024 compared to 2019

There will continue to be diverged interests among Chinese consumers: Some still opt for domestic staycations like those in Hainan, while others are drawn to nearby destinations for the attractive rates.

A CRM Manager at Valentino noted that attracting Chinese luxury consumers back to shop domestically would be challenging due to a lack of compelling incentives. She also pointed out that Chinese consumers tend to prefer shopping in Japan, Singapore, and Thailand – countries that offer easy or visa-free travel, making them more attractive as shopping destinations.

It’s clear: Now is the time for brands to invest not just in the China market but also in Chinese consumers.

Brands must create incentives and narratives that drive sales, engagement, and loyalty through a solid CRM strategy that caters to Chinese customers both in China and abroad throughout their journey, no matter where they are.

Approaches to Capturing Chinese Luxury Shoppers

1. Relationship Building

For retaining Loyalists, building a genuine and authentic relationship between the client and the Sales Associate is crucial.

This relationship should feel more like a friendship than a typical client-staff interaction. While this may blur the lines of professionalism, a deeper personal connection allows Sales Associates to better understand and cater to their clients’ needs.

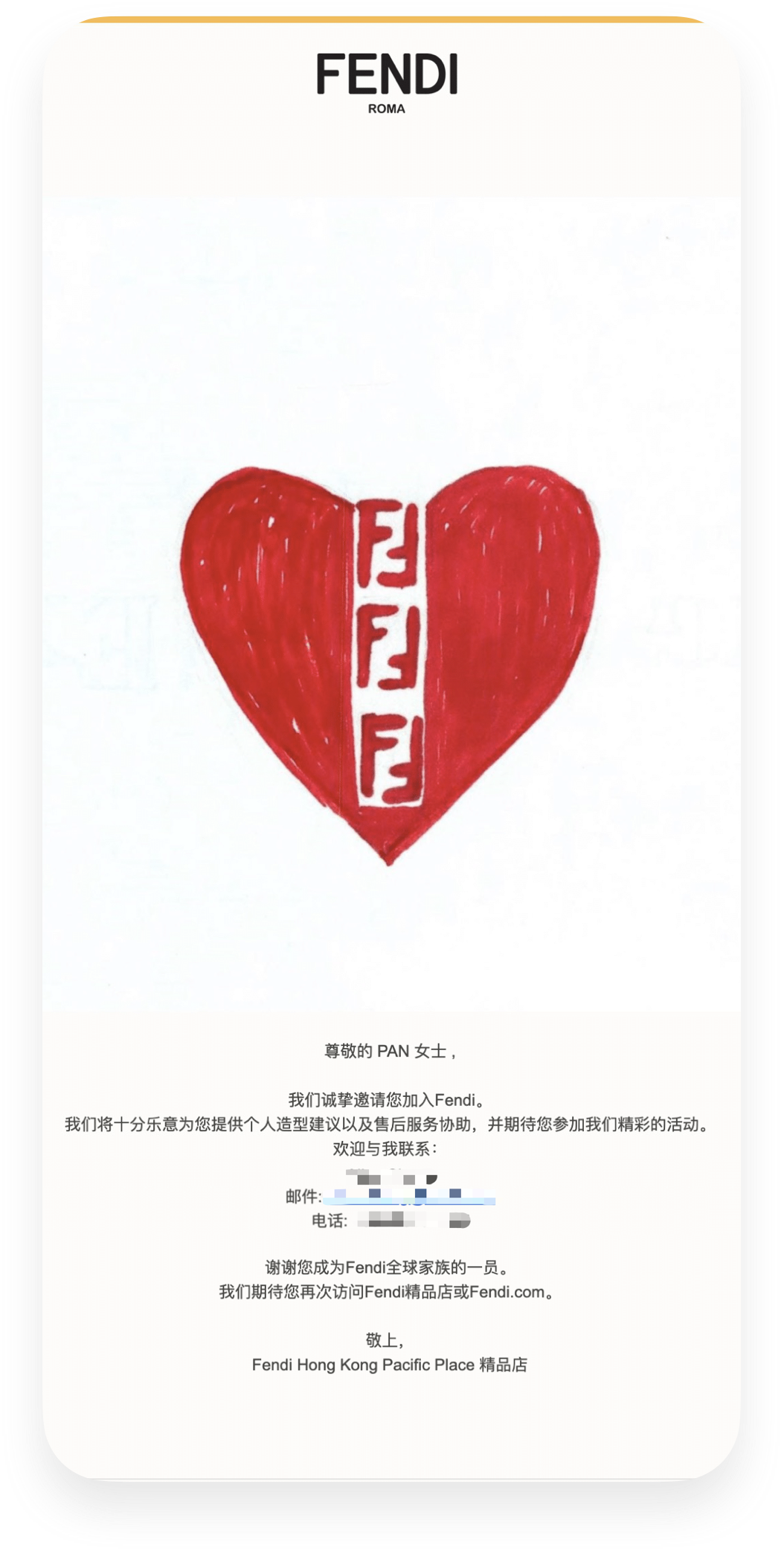

- Client activation should be constant, organic, and authentic. Sales staff should leverage all available data (e.g., birthdays, local special events) to personalize interactions and offerings.

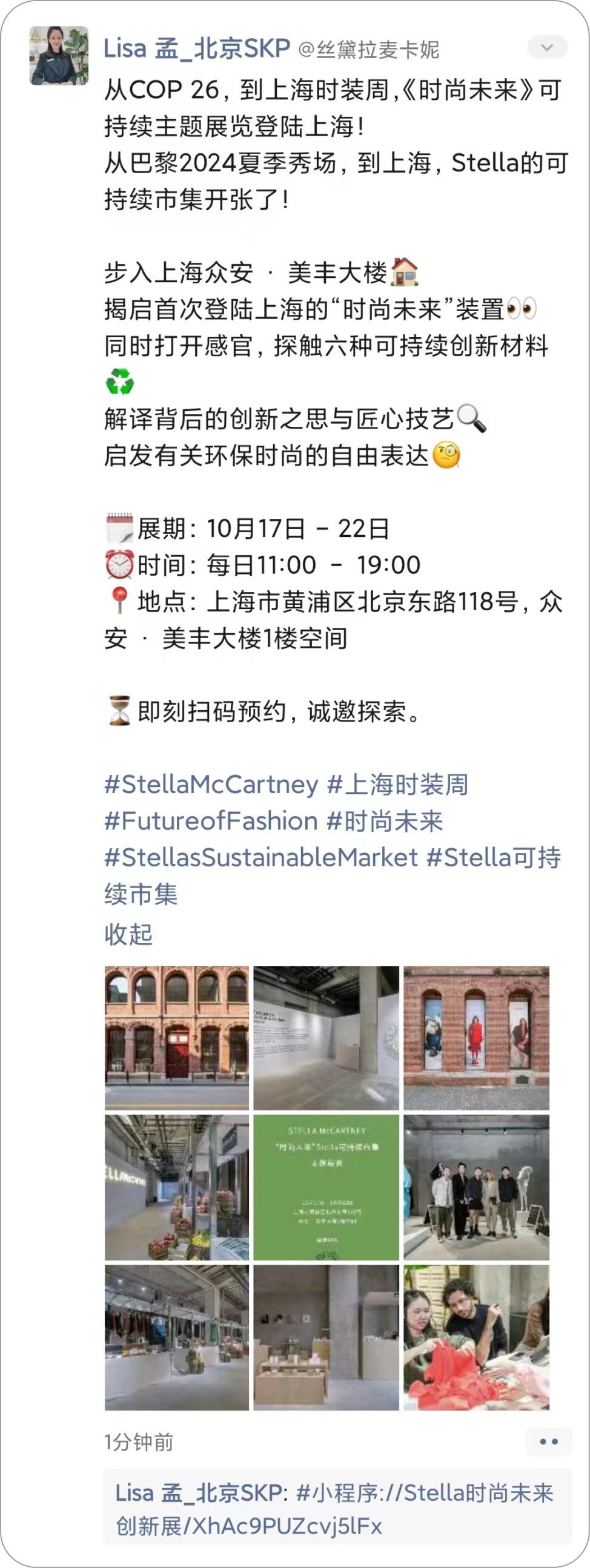

- Brands and salespeople also need to leverage all clienteling and communication channels (e.g., social media) to deliver a seamless, superior experience. Chinese consumers value outstanding service and are more likely to remain loyal to brands that consistently provide it – the key point of difference.

2. VIP Activations

Many brands are heavily investing in VIP activations to attract and provide clients with exceptional experiences. These events not only enhance client satisfaction but also create opportunities for cross-selling and strengthening the relationship between Sales Associates and their clients.

However, VIP activations are often exclusive to local clients who have established a relationship with the brand or store. A key client in Paris may not receive an invitation to events in Shanghai, despite their significant spending history, if they are not included in the Shanghai CRM VIC/VVIC list.

For example: Hermès prioritizes local clients for the exclusive bags Kelly and Birkin. These bags are offered at random times throughout the year, with a 24-hour window for the client to make a purchase, ensuring that only local clients are given priority.

3. Omni-Global Clienteling

As Chinese luxury spending continues to spread across nearby destinations for attractive rates, longer-haul trips back to Europe, and domestic markets, brands need to enhance their clienteling and service offerings through their global store network.

The key is to maintain a strong relationship between the client and their Sales Associate and build a strong global x local clienteling and CRM foundation.

For instance, if a client in Beijing mentions they will be traveling to Osaka in the next two weeks, their local Sales Associate can connect them with a consultant in that city to ensure a seamless, omni-global clienteling experience. This might involve setting up appointments establishing a point of contact, and following up post-trip.

The Future of Clienteling – What Needs to Change?

The tools for clienteling are already available, but the real challenges lie beyond the technology itself. At its core, clienteling is a human-centric approach in luxury retail. Even with the best tools, if the retail team is not fully equipped to use them effectively, the results will be limited.

Laura Pan – Lecturer on Luxury Strategy, Tech, and Chinese Consumer Behavior at SDA Bocconi

Even with the best tools, if the retail team is not equipped to use them effectively, the results will fall short. Take Dolce & Gabbana, for instance. Despite acquiring the industry-leading CRM platform Tulip, their client activations remain disappointingly low.

Effective clienteling also starts with the collection of customer data.

In the West, this process often relies on outdated methods like paper forms or time-consuming digital entry which clients may not see the value in participating.

Some brands are innovating to streamline data collection. Richemont U.S. introduced an “appointment only” policy for its specialty watch brands. Customers must book an appointment either by phone or through the brand’s website, allowing them to enter their data from the comfort of their own homes.

This method incentivizes data collection by aligning it with the customer’s intention to view a product. However, this approach may not be applicable across the entire luxury industry, especially in fashion, which still relies heavily on walk-in customers.

At Louis Vuitton, every customer visiting the store is first asked to provide their information to the hostess at the entrance. The rationale given to customers is that this step ensures they are paired with the sales consultant best suited to their needs.

For instance, a customer looking for bags would be paired with a consultant specializing in that category. Hermès and Chanel employ similar approaches. By integrating data collection into the initial stages of customer interaction, these brands ensure they have some basic information to tailor the customer journey right from the start.

This approach is still relatively uncommon in China, possibly due to cultural differences, but it holds significant potential.

Many brands are enhancing their data collection using WeCom. By having customers scan Sales Associates’ WeCom QR codes, Associates can directly/manually record client information during both in-store and online interactions on WeCom, contributing to building holistic customer profiles in the central CRM.

This article is the full version of Laura Pan’s contribution to ITC Insights Vol.1 whitepaper, where we take a deep dive into how brands can empower digital transformation for elevated clienteling in China.