About the Client: GlaxoSmithKline (GSK)

GlaxoSmithKline (GSK), a global leader in consumer healthcare and pharmaceuticals, was formed in 2000 through the merger of Glaxo Wellcome and SmithKline Beecham.

Headquartered in London, GSK operates in over 75 markets, employs more than 65,000 people, and manufactures across 37 global sites.

Renowned for its research-driven approach, GSK invests heavily in laboratory upgrades, clinical trials, and scientific partnerships.

Its consumer healthcare portfolio includes the globally trusted Sensodyne oral care brand. Since 2022, this product line has been part of Haleon, a corporate spin-off from GSK.

Goal & Objectives

GSK sought to accelerate revenue growth for its Sensodyne brand in China’s competitive consumer healthcare market, prioritizing maximum visibility to maintain its market leadership and significantly expanding the number of stores distributing its products.

This required navigating a complex B2B2B2C model:

- First B: Sensodyne, GSK’s flagship oral care brand.

- Second B: Distributors (and occasionally Sub-Distributors), managing product supply and Retailer relationships.

- Third B: Retail shops, such as grocery stores and hypermarkets, selling to end consumers.

- Fourth C: Consumers purchasing Sensodyne products.

The B2B2B2C structure posed significant challenges for data sharing, as information needed to flow seamlessly across GSK (Sensodyne), Distributors, Sub-Distributors, and Retailers.

These challenges were compounded by China’s Personal Information Protection Law (PIPL), which mandates strict compliance on data consent, minimization, and security – with non-compliance risking legal and reputational consequences.

Digital transformation of this multi-tiered model added further complexity. Stakeholders — GSK’s Sales teams, Distributors, Sub-Distributors, and Retailers — relied on disparate systems for inventory, CRM, and communication, each tailored to their workflows.

Integrating new solutions without disrupting existing standard operating procedures (SOPs) was critical to ensure adoption and augment capabilities.

The challenge was to strategically select and integrate systems that enhanced visibility, streamlined processes, and supported scalability while preserving SOPs across the B2B2B2C chain.

A strategic E-Go-to-Market (E-GTM) roadmap was developed to address four key priorities:

- Enhance Retail Network Visibility: Deliver deeper insights into Distributors and Retailers through robust, PIPL-compliant data collection and comprehensive partner profiles to ensure Sensodyne’s market prominence.

- Strengthen Distribution Relationships: Design loyalty initiatives to deepen engagement and foster long-term collaboration across the B2B2B2C chain, supporting store expansion.

- Streamline Onboarding and Communication: Equip GSK’s Sales team with tools and processes for efficient, compliant partner onboarding and engagement to drive distribution growth.

- Build Scalable Digital Infrastructure: Establish a centralized, PIPL-compliant system integrating CRM, WeCom clienteling, and Marketing Automation to support future growth without disrupting existing operations.

Solutions

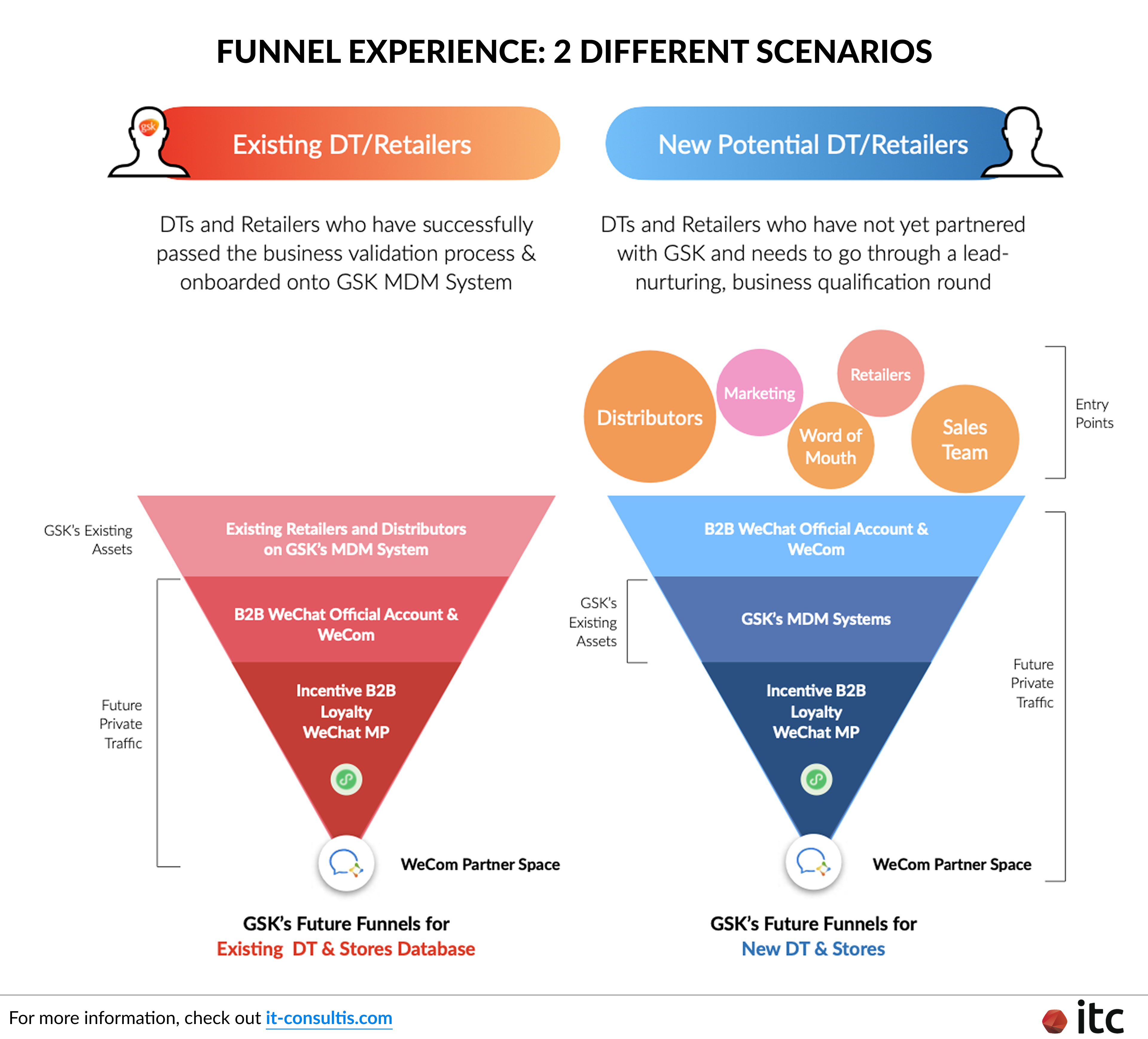

A comprehensive E-GTM strategy was delivered through a two-phase process, combining stakeholder analysis with a tailored digital transformation roadmap designed to address the B2B2B2C model’s complexities, PIPL compliance, and the integration of disparate systems.

Phase 1: Stakeholder Analysis and Persona Mapping

Interviews were conducted with GSK’s Sales teams, including City Sales Managers (CSMs), Territory Sales Managers (TSMs), and Regional Sales Managers (RSMs), to map workflows, challenges, and priorities in China. These discussions revealed opportunities to:

- Expand store integration and strengthen Retailer relationships to boost Sensodyne’s distribution footprint.

- Enhance data collection to improve forecasting and performance evaluation while adhering to PIPL’s data protection requirements.

- Restructure incentive programs to deepen Distributor and Sub-Distributor engagement, supporting market visibility.

The analysis highlighted fragmentation caused by multiple systems across the B2B2B2C chain.

GSK’s Sales teams used internal CRM platforms, Distributors relied on proprietary inventory tools, and Retailers operated with point-of-sale systems – creating data silos that obscured Sensodyne’s market performance.

PIPL compliance further complicates data sharing, requiring secure, consent-driven processes, especially at the consumer level. Based on these insights, three key personas were defined:

- Distributors (and Sub-Distributors): Responsible for fulfilling Retailer orders, driving store expansion, and analyzing market trends. Opportunities included PIPL-compliant technical support, streamlined onboarding, and incentives to promote Sensodyne.

- Retailers: Encompassing grocery stores, hypermarkets, and convenience stores, Retailers required regular product updates, targeted incentives, and accessible training to elevate Sensodyne’s market presence, with data-sharing processes aligned with PIPL.

- GSK Sales Team: Tasked with onboarding partners and maintaining engagement, the team needed integrated, compliant communication tools to optimize performance and visibility across the B2B2B2C chain.

Phase 2: Strategic Roadmap and Digital Solutions

Leveraging persona insights, a three-pillar E-GTM strategy was developed to empower GSK’s distribution ecosystem, integrate disparate systems, ensure PIPL compliance, and maximize Sensodyne’s market visibility without disrupting existing SOPs:

1. B2B Loyalty Program

A WeChat Mini Program was proposed to foster loyalty among Distributors, Sub-Distributors, and Retailers, structured around a tiered system (Bronze, Silver, Gold, Titanium) based on partnership duration, purchase volume, frequency, and referrals.

Gamified challenges, exclusive benefits, and a referral scheme were designed to drive engagement and encourage store expansion.

To comply with PIPL, the program incorporated opt-in consent mechanisms and anonymized data processing. The Mini Program was designed to integrate with existing Distributor and Retailer systems, ensuring seamless adoption without altering their SOPs.

2. Marketing Automation and WeCom Clienteling

To deliver personalized, compliant partner experiences while enhancing Sensodyne’s visibility, the following actions were recommended:

- Transitioning Sales team communications from personal WeChat accounts to WeCom, a PIPL-compliant clienteling solution that centralized engagement tracking and ensured professional interactions. WeCom was configured to sync with GSK’s existing CRM, minimizing disruption to Sales team workflows.

- Integrating a Social CRM (sCRM) with GSK’s WeChat ecosystem (Official Account, Mini Program), WeCom, and website to build holistic, PIPL-compliant partner profiles and track engagement across the B2B2B2C chain.

- Implementing personalized Welcome Messages, segmented tagging, and a Lead Scoring Strategy to prioritize high-value partners, with data collection limited to PIPL requirements.

- Deploying ChatBot automation and enhanced customer service within GSK’s WeChat channels, ensuring secure data handling.

3. Business Intelligence Integration

A unified tech stack was proposed to connect the Loyalty Program, sCRM, and WeCom with GSK’s existing systems, addressing the B2B2B2C model’s data-sharing challenges.

This created a centralized, PIPL-compliant ecosystem that synchronized data across Sensodyne, Distributors, Sub-Distributors, Retailers, and consumer touchpoints.

The solution was designed to integrate with disparate systems (e.g., Distributor inventory tools, Retailer POS systems) through APIs and middleware, ensuring real-time insights without requiring stakeholders to overhaul their SOPs.

Finally, the implementation of automated workflows and complete partner profiles was recommended to empower the Sales and Marketing teams, boost Sensodyne’s visibility, and support significant store expansion through data-driven decisions.

Results

The E-Go-to-Market strategy was designed to position GSK for success in China’s consumer healthcare market by strengthening Sensodyne’s market presence and distribution network.

The proposed roadmap aimed to enhance visibility across the B2B2B2C ecosystem, ensuring Sensodyne maintained its leadership in the oral healthcare segment.

By fostering stronger relationships with Distributors, Sub-Distributors, and Retailers, the strategy sought to drive significant expansion of Sensodyne’s store footprint.

The integration of a scalable, PIPL-compliant digital infrastructure, tailored to complement existing systems, was crafted to streamline operations and empower GSK’s Sales team with efficient, data-driven tools.

Overall, this approach was designed to support GSK’s long-term growth, combining innovation with steady operations in a challenging and fast-changing market.