In a world where digital borders are fading faster than ever, Tencent is doubling down on familiarity. With the launch of TenPay Global Checkout, the company is taking a decisive step toward making cross-border WeChat Mini Program payments feel as seamless as domestic ones.

Executive Summary:

1. TenPay Global Checkout addresses long-standing friction in overseas Mini Program payments by enabling a fully native, seamless checkout experience for users outside mainland China.

2. For global Chinese communities, it unlocks a wide range of local payment methods — from international cards to regional digital wallets — making cross-border Mini Program transactions significantly easier.

3. For international visitors in mainland China, TenPay Global will soon allow payments either by scanning a WeChat Pay QR code, showing their own e-wallet QR code, using an international card linked to WeChat Pay, or paying through other supported global wallets.

4. Looking ahead, Tencent must ensure strong regulatory compliance, market trust, and reliable global scaling to sustain adoption and maximize the impact of this upgrade.

Table of contents

Overview: China’s Digital and Mobile Commerce Landscape

The Great Firewall has prompted China’s digital landscape to evolve differently from the rest of the world, shaping its own platforms, consumer behaviors, and regulations. This includes the rise of:

Local Super-App Ecosystems

Unlike Western markets dominated by global giants, China’s internet is home to a vibrant ecosystem of local tech leaders who have built powerful, all-in-one superapps.

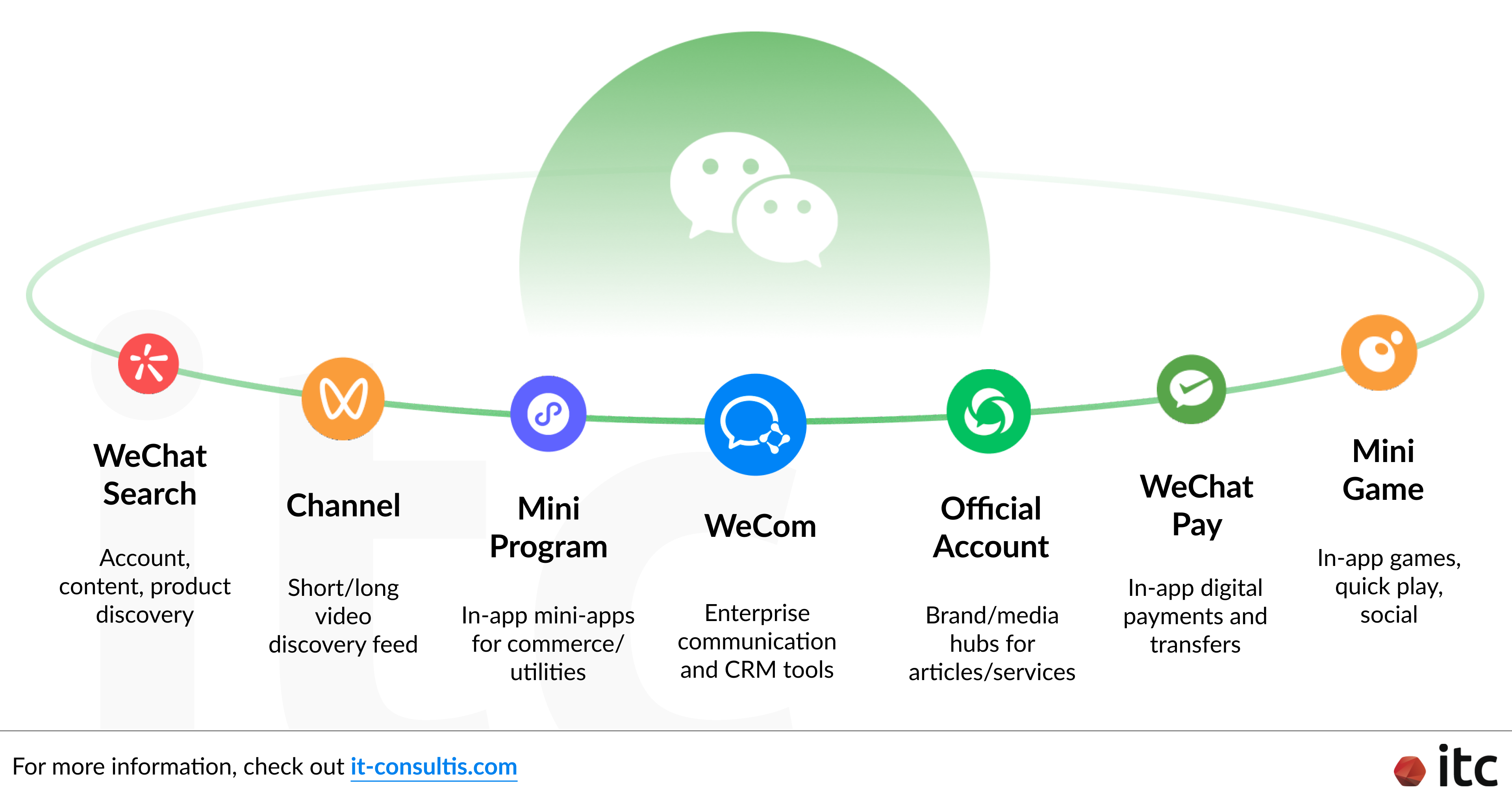

These platforms — most notably WeChat (developed by Tencent) — combine messaging, social media, payments, e-commerce, and more into a single, seamless experience.

Mobile Commerce and Digital Wallets

Another unique factor about China’s digital ecosystem is the insanely high and deep mobile penetration rate. By 2026, smartphone penetration in the country is projected to reach 81%, reflecting the rapid expansion of mobile access across both urban and rural populations.

Additionally, instead of relying on traditional credit cards and global payment methods (which are not widely accessible in China), Chinese consumers have embraced local digital wallets and payment solutions embedded within superapps — propelling the mobile commerce trend in China.

WeChat, for example, allows users to interact with brands, shop on WeChat Mini Programs, and pay with WeChat Pay without ever leaving the app:

- WeChat Mini Programs (mini-apps within WeChat) are now a primary channel for services and e-commerce, with more than 1.2 billion monthly active users across key markets in 2024.

- WeChat Pay has become one of China’s dominant digital wallets, powering over 85% of urban transactions in 2024, contributing to making mobile payments the everyday norm.

This integration not only makes it easier for businesses to reach and convert customers but also forms the backbone of China’s mobile-first commerce experience, where most transactions rely on local payment methods.

However, while this tightly integrated ecosystem works seamlessly for domestic users, it creates significant challenges for the Chinese diaspora, international travelers, and global consumers who struggle to access a seamless payment experience with Chinese vendors.

The Challenge: Payments for Overseas Mini Program Users

Friction in Cross-Border Payment Experiences

Until recently, international users — whether members of the Chinese diaspora, travelers, or global consumers — faced limited payment options when using Mini Programs outside China.

At the same time, international travelers in China encountered similar friction, as most local methods required a Chinese bank account. In both cases, users simply couldn’t pay through the native, integrated local payment methods they were familiar with.

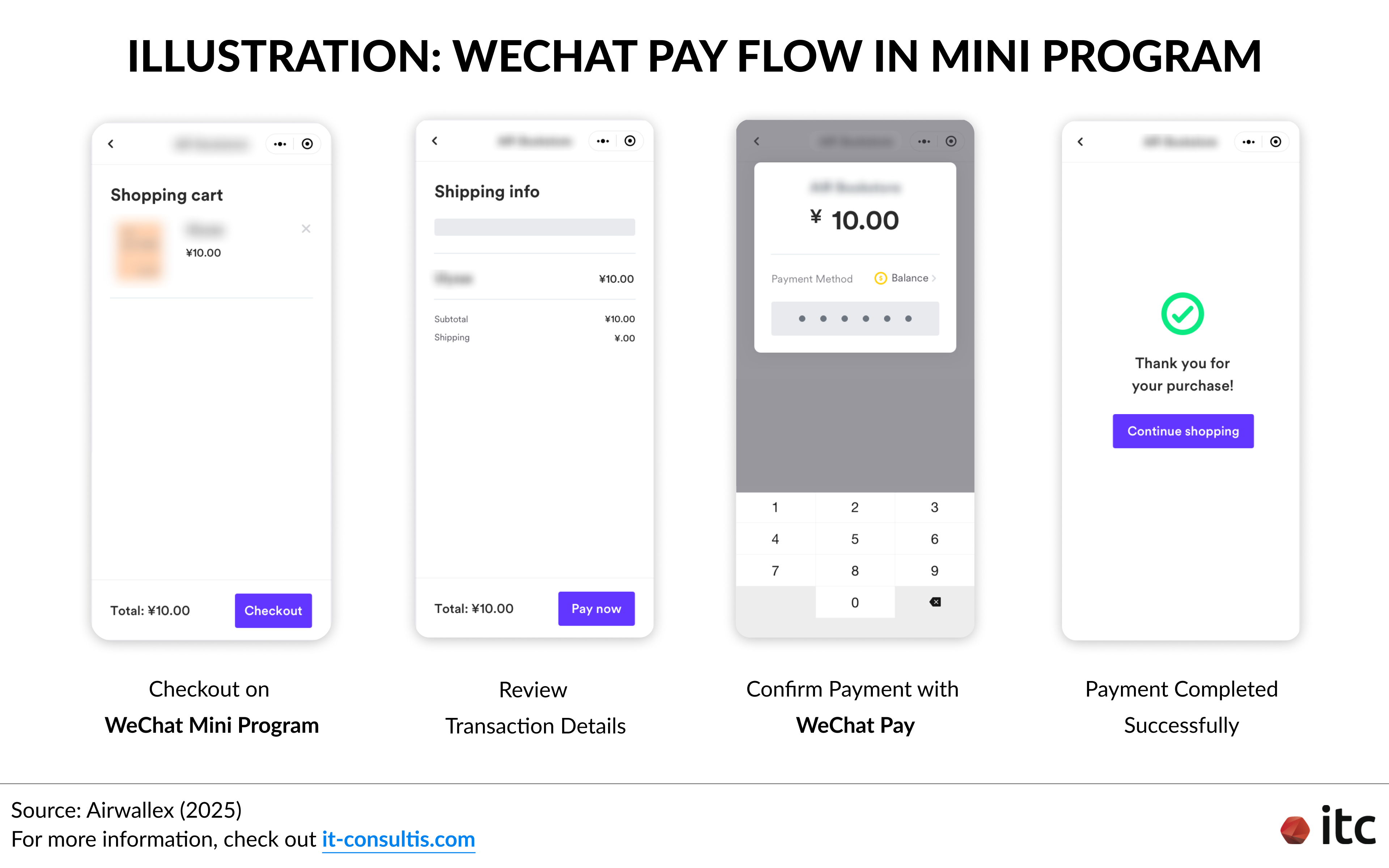

Many Mini Program operators had to redirect users to external payment gateways or legacy third-party systems, which breaks the smooth in-app flow and leads to higher checkout abandonment.

Impact on Brands and Conversion

For brands, this payment friction had tangible consequences:

- Lower conversion rates due to increased checkout abandonment.

- Limited ability to monetize overseas users effectively.

- Difficulty reaching and engaging international customers or the Chinese diaspora without a native, integrated payment solution.

As a result, many potential sales and user segments remained untapped, constraining global expansion and revenue growth for brands relying on Mini Programs as a commerce channel.

Tencent Launches “TenPay Global Checkout” to Bridge Cross-Border Payments

Announced in November 2025, the launch of TenPay Global Checkout marks a major step in supporting cross-border transactions.

For Global Chinese Communities

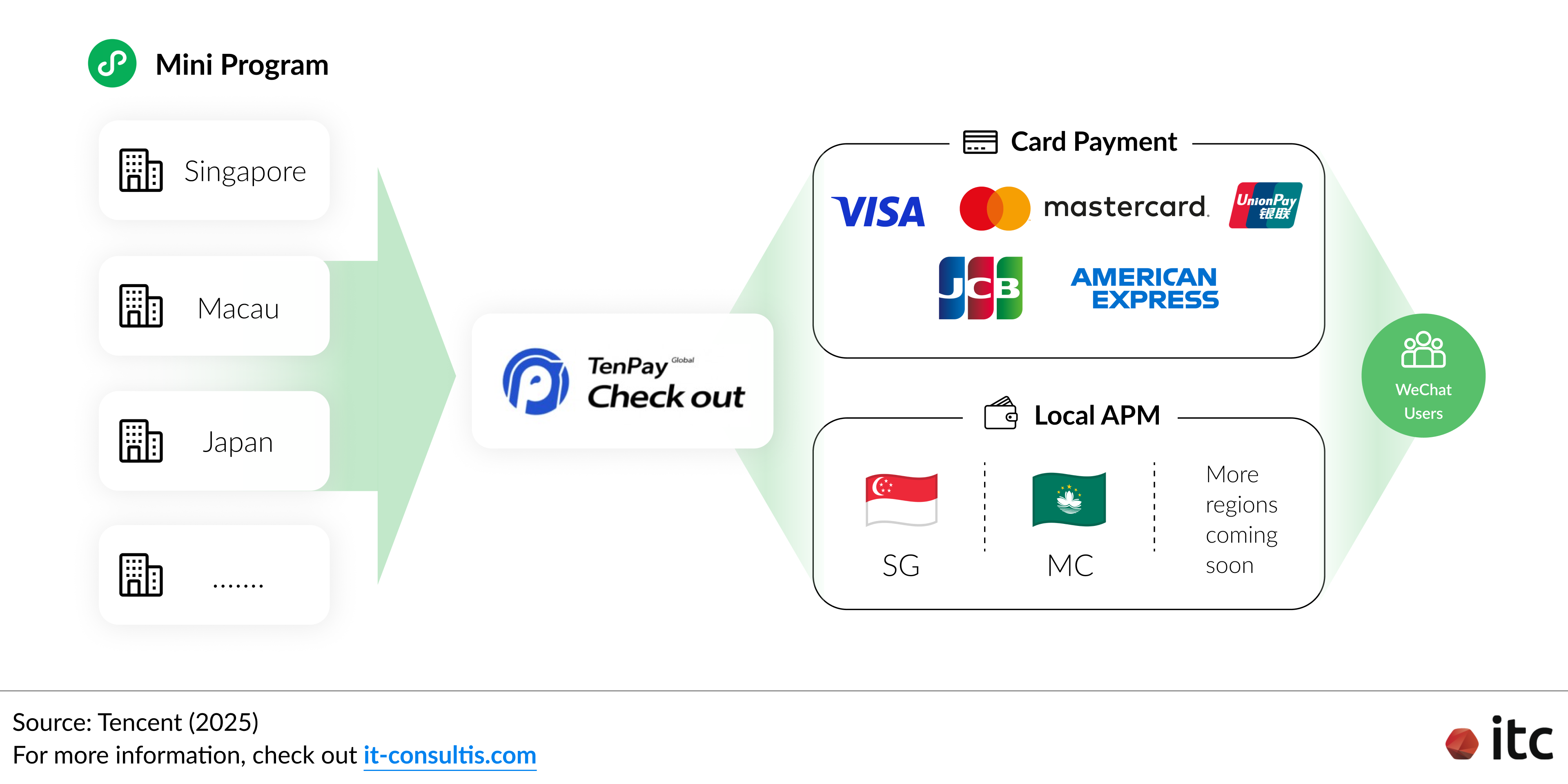

WeChat Mini Programs can now support a wide range of local payment methods — from international credit and debit cards to regional digital wallets and real-time payment networks — simplifying cross-border transactions.

The rollout begins in Singapore and Macao SAR, where users can pay via local credit/debit cards, PayNow, and BOCPAY (Macao) directly within Mini Programs. Tencent plans to expand to Japan, Australia, and New Zealand, gradually enabling seamless payments for global users across more markets.

Besides, the company also tackles local regulatory challenges by securing licenses and ensuring compliance in each new market.

For International Visitors in Mainland China

TenPay Global and WeChat Pay will continue to enhance their payment ecosystem. International visitors in China will soon be able to make payments in China through multiple supported methods:

In-store payments:

- Scan a WeChat Pay QR code at the store using their own digital wallet.

- Present their own digital wallet QR code for the store to scan (e.g., PayPal, GrabPay, ShopeePay).

Online payments:

- Pay with an international credit or debit card linked to WeChat Pay (e.g., Visa, Mastercard).

- Use other supported global digital wallets integrated through TenPay Global (e.g., WeChat Pay HK, Zalopay).

These options enable frictionless payments at tens of millions of locations across mainland China, without downloading WeChat or completing additional setup, making it easier for visitors to explore, experience, and enjoy their journeys.

By embedding local payment methods directly into Mini Programs, TenPay Global Checkout eliminates the former need for external redirects or third‑party gateways — restoring the frictionless, native experience that defines Mini Programs.

Future Implications

For Tencent: Future Opportunities and Risks

As TenPay Global Checkout expands internationally, Tencent will face both strong opportunities and meaningful challenges. To succeed, the company must navigate competitive, regulatory, and consumer-trust barriers across markets.

- Building trust and brand recognition will require significant marketing investment, especially in regions dominated by players like PayPal and Stripe.

- Operating across diverse regulatory environments means Tencent must continue to secure local licenses and ensure full compliance.

- Localizing payment methods, user experience, and market onboarding will be critical to driving adoption.

- Long-term success will depend on Tencent’s ability to scale the Mini Program ecosystem globally while maintaining reliability, security, and developer-friendly integration.

For Brands: TenPay Global Unlocks New Value Across Industries

TenPay Global Checkout addresses a key pain point in China’s mobile-first ecosystem: enabling seamless, cross-border payments for international users and the Chinese diaspora.

This advancement can open new opportunities for various industries such as travel, entertainment, integrated resorts, hotels, airports, shopping malls, luxury, and more.

Brands in these sectors can now:

- Boost conversion by allowing international users to pay without external redirects, reducing abandonment, and unlocking new revenue.

- Expand global reach by engaging overseas Chinese communities and international travelers through a familiar, integrated payment ecosystem.

- Enhance customer experience with frictionless transactions that drive loyalty and repeat visits.

This integration not only streamlines the customer journey from discovery to purchase but also enables brands to tap into WeChat’s powerful social, CRM, and data capabilities to drive personalized engagement, loyalty, and long-term growth.

At IT Consultis (ITC), we guide global and local brands through China’s complex digital landscape, including supporting the integration of advanced payment solutions such as TenPay Global and private-domain operations on WeChat.

Our expertise in the WeChat ecosystem, API management, system integrations, and data compliance ensures businesses can deliver seamless cross-border payment experiences while maximizing their full potential on WeChat.